If you’re a healthcare provider, medical biller, or practice manager, understanding EOBs (Explanation of Benefits) isn’t just helpful—it’s essential. EOBs are the backbone of the payment process. They help you reconcile payments, appeal denials, and ensure that your revenue cycle stays healthy and compliant.

This guide discusses what an EOB is, what it includes, how to read one, and how to use it to optimize your billing and collections.

What Is an Explanation of Benefits (EOB)?

An Explanation of Benefits (EOB) in medical billing is a document sent by a health insurance company to the provider and/or the patient after a medical claim has been processed. It explains how the claim was evaluated and how much was paid to the provider, along with the patient’s responsibility (if any).

Important: An EOB is not a bill, although it is often mistaken for one.

Example:

A patient sees a provider for an in-office consultation. After the provider submits a claim to the insurance company, the insurer sends back an EOB. It might say:

- Charged amount: $200

- Allowed amount: $150

- Paid by insurance: $120

- Patient responsibility (copay + deductible): $30

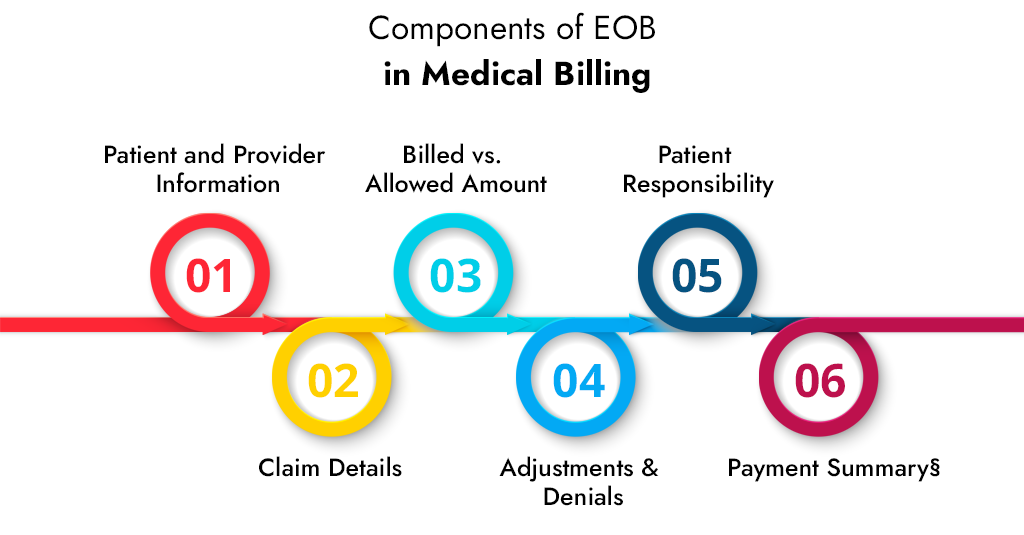

Components of EOB in Medical Billing

A well-structured EOB in medical billing typically includes the following key sections:

1. Patient and Provider Information

This section helps match the EOB with your records and ensures the claim belongs to the correct case.

- Name of the patient

- Provider or practice name

- Policy or member ID number

- Date of service

2. Claim Details

This outlines the services rendered, often by CPT/HCPCS codes:

- CPT code (e.g., 99214 for an established office visit)

- Description (e.g., “Level 4 Office Visit”)

- Service date

3. Billed vs. Allowed Amount

If you charge $200 for a service but the allowed amount is only $150, you cannot bill the patient the $50 difference unless you’re out-of-network.

- The billed amount is what the provider charged.

- The allowed amount is the maximum amount that the insurance company agrees to pay, as outlined in their fee schedule.

4. Adjustments & Denials

You must know how to decode these using the insurance carrier’s denial code glossary.

- Adjustment codes, such as CO-45 (contractual obligation), explain why part of the charge isn’t paid.

- Denial Codes (e.g., CO-96 – “non-covered service”) provide reasons for denial.

5. Patient Responsibility

Patient responsibility refers to the amount that can be collected from the patient after the insurance company has paid its share.

This includes:

- Copayment

- Deductible

- Coinsurance

6. Payment Summary

- Total paid to the provider

- Any amount paid to the patient (e.g., if the patient paid out-of-pocket and is due reimbursement)

Why EOBs Matter for Your Practice

Most healthcare practices see the Explanation of Benefits (EOB) as just another piece of paper or digital notice — but that’s a costly oversight.

According to the 2024 MGMA Financial Performance Report, nearly 67% of claim denials could be resolved simply by reviewing the EOB in detail and taking the right follow-up action. That means the EOB is more than a summary — it’s your first line of defense against lost revenue.

Let’s break down why EOBs are indispensable tools for revenue cycle optimization:

Verifying Claim Outcomes

The EOB in medical billing provides detailed information on how the payer processed a claim. Was it approved? Denied? Partially paid? Delayed?

Identifying Underpayments and Incorrect Adjustments

Payers often make adjustments based on contractual rates, bundling edits, or modifiers. But mistakes happen. An EOB allows you to compare the amount paid with the expected amount using your fee schedule.

Supporting Denial Management & Appeals

Every EOB includes a denial reason code and a remark code. These are crucial for crafting strong appeal letters.

Reconciling Accounts & Closing Revenue Gaps

EOBs are vital for payment posting and account reconciliation. They ensure that the correct amount is posted to the patient ledger and any remaining balance is either written off, billed to the patient, or flagged for follow-up.

Tracking Recurring Issues by Payer or Procedure

By analyzing trends across multiple EOBs, you can detect:

- Repeated denial patterns for certain CPT codes

- Systemic underpayments from specific insurers

- Modifier mismatches that trigger automatic rejections

How to Read an EOB Like a Pro

At first glance, an Explanation of Benefits (EOB) might look like alphabet soup — full of codes, columns, and confusing jargon. But once you break it down, it becomes one of the most powerful revenue tools in your billing workflow.

Let’s walk through a typical EOB line item and decode it step by step:

| CPT Code | Charge | Allowed | Paid | Adjusted | Patient Owes |

| 99213 | $150 | $120 | $90 | $30 (CO-45) | $30 (Deductible) |

CPT Code (99213)

This code refers to a Level 3 Established Patient Office Visit, a common Evaluation & Management (E/M) service.

Charge ($150)

This is the Amount your practice billed for the service — in this case, $150 for a 99213 visit.

This may be your usual and customary fee (UCF) or chargemaster rate.

Allowed amount ($120)

The payer’s contracted allowable amount for this CPT code. It’s based on your provider contract with the insurer — you agreed to accept $120, not the full $150.

Think of this as the “negotiated price” — it defines how much is payable.

Paid amount ($90)

The amount the insurance company paid. They didn’t pay the full $120 — why? Let’s keep reading.

Adjusted amount ($30 with CO-45)

This is the difference between your charge and the allowed amount — and it’s written off. The adjustment reason code CO-45 stands for: “Charge exceeds fee schedule/maximum allowable amount.”

You’re not collecting this $30 from anyone — it’s a contractual write-off required by the payer agreement.

Patient Responsibility ($30 Deductible)

This amount is the patient’s financial responsibility. In this example, the remaining $30 of the allowed amount wasn’t paid by the insurer because it applies to the patient’s annual deductible.

This is collectable, but only if your front desk or billing team has properly informed and invoiced the patient.

In a nutshell:

- You billed $150.

- The insurer only allows $120.

- Of that $120:

- They paid $90.

- The patient owes $30 (deductible).

- You write off $30.

- Total revenue potential = $120 (payer + patient combined).

EOB vs ERA vs Medical Bill: What’s the Difference?

Understanding these three documents is critical for mastering the revenue cycle. Confusion between them leads to billing errors, missed payments, and frustrated patients. Here’s everything you need to know — with real examples.

Explanation of Benefits (EOB) – What Patients Receive from the Payer

An EOB is not a bill. It’s a summary report issued by the insurance company after it processes a claim submitted by your practice.

- It tells you how much was paid, why, and by whom.

- You use it to reconcile payments with your expected reimbursements.

- If something is underpaid or denied, the EOB provides a reason code (such as CO-45 for contractual adjustment or CO-197 for expired eligibility).

- It serves as a legal document for patient billing and appeals.

Key Components of an EOB are:

- Provider: Name of your clinic or the servicing provider

- Patient: Name of the insured patient

- Service Codes (CPTs): What was billed (e.g., 99213 – office visit)

- Billed Amount: What you charged (e.g., $150)

- Allowed Amount: What the insurer considers payable under the contract (e.g., $120)

- Paid by Insurance: What they paid (e.g., $90)

- Adjustment/Write-Off: The Amount you’re contractually obligated to write off (e.g., $30 with CO-45 code)

- Patient Responsibility: What the patient must pay (e.g., $30 coinsurance or deductible)

- Denial Codes: If applicable, reason codes for non-payment or partial payment (e.g., CO-97, CO-16)

Electronic Remittance Advice (ERA) – What Providers Receive Digitally from the Payer

An ERA is the electronic version of an EOB. Instead of receiving paper forms in the mail, they are delivered directly into your EMR/billing software in the ANSI X12 835 file format.

Why it matters:

- Faster payment posting: ERA enables you to post 100 claims in 3 minutes, compared to 3 hours with manual EOBs.

- Fewer errors: Auto-matching ensures accuracy and prevents over- or under-billing.

- Actionable data: You can quickly spot trends in denials or payer behavior and take action.

Key Features of ERAs:

- Auto-posting: Most billing systems (Kareo, AdvancedMD, Athenahealth) can automatically post payments from ERA files

- Adjustment Codes: Detailed Claim Adjustment Reason Codes (CARC) and Remittance Advice Remark Codes (RARC)

- Batch Payments: You’ll get one ERA for dozens or hundreds of claims at once

- Electronic Reconciliation: Streamlines matching payments, adjustments, and patient balances in your system

Medical Bill (Patient Statement) – What You Send the Patient

Once insurance processes the claim (and sends the EOB or ERA), your practice will generate a medical bill for any remaining balance that the patient owes.

Why It Matters:

- It’s the final touchpoint with your patient and directly affects your collections.

- If this doesn’t match their EOB, expect calls or non-payment.

- Clarity equals cash flow—confusion equals complaints and an A/R backlog.

What’s Included:

- Balance Due: What the patient owes after insurance

- Date of Service: When the service occurred

- Description: Description of service (e.g., “Follow-up Office Visit”)

- CPT Code: Optional, but helpful for accuracy (e.g., 99214)

- Payment Options: Online portals, check mailing address, phone pay line

- Contact Info: So patients can dispute or inquire about charges

EOB, ERA, Medical Bill: A Comparison Chart

| Feature | EOB | ERA | Medical Bill |

| Who Sends It? | Insurance Company | Insurance Company | Your Practice |

| Recipient | Patient (copy to provider) | Billing System / Clearinghouse | Patient |

| Format | Paper or PDF | ANSI X12 835 (Electronic) | Paper, Email, Portal |

| Billing Tool? | ❌ No | ❌ No | ✅ Yes |

| Contains CPT Codes? | ✅ Yes | ✅ Yes | ✅ Yes |

| Auto-Posts to EMR? | ❌ No | ✅ Yes | ❌ No |

| Action Required? | Review, Appeal if needed | Reconcile, Post Payments | Collect from Patient |

Major EOB Mistakes & How to Avoid Them

Ignoring Adjustment Codes

Mistake: Failing to interpret CO, PR, or OA codes correctly can result in incorrect patient billing or missed appeals.

Tip: Maintain a current list of denial/adjustment codes and train your billing team to decode them regularly. Use clearinghouse or payer portals for code definitions.

Not Reconciling EOBs With Patient Accounts

Mistake: Posting payments without cross-checking against your EHR/PM system can lead to revenue leakage.

Tip: Always reconcile EOB line items with the practice management software to ensure all patient balances are updated accurately.

Missing Timely Filing or Appeal Deadlines

Mistake: Delayed review of EOBs may result in losing the window to appeal underpaid or denied claims.

Tip: Set automated reminders or worklists in your billing software to track appeal deadlines, which are typically 30 to 90 days from the EOB date.

Overbilling the Patient

Mistake: Billing the patient the full allowed amount instead of subtracting insurer payments or write-offs.

Tip: Always subtract “Paid” and “Adjusted” amounts before issuing patient statements. Use EOBs to confirm patient responsibility.

Not Reviewing Recurring Denials

Mistake: Ignoring patterns in denials can lead to a high denial rate and low revenue.

Tip: Run monthly EOB analytics or denial trend reports to identify and correct recurring issues, such as coding errors or missing prior authorization.

Discarding EOBs Too Early

Mistake: Some practices discard EOBs after posting — but they’re essential during audits, appeals, or payer disputes.

Tip: Store EOBs (or ERAs) securely for at least 7 years, ideally in digital format for easy retrieval during audits.

Failing to Educate Front Desk or Patient Coordinators

Mistake: If the front desk doesn’t understand EOB basics, they may misinform patients about balances or payments.

Tip: Train front-office teams on EOB interpretation, especially on patient portions such as deductibles, coinsurance, and copays.

Conclusion

Explanation of Benefits (EOBs) are more than just payment summaries — they’re diagnostic tools for the financial health of your practice. By understanding how to read, interpret, and act on EOBs correctly, you can:

- Maximize reimbursements

- Reduce claim denials

- Avoid compliance pitfalls

- Improve patient transparency

- Uncover billing inefficiencies

In short, mastering EOB in medical billing helps you plug revenue leaks, streamline your RCM workflow, and maintain complete control over your bottom line. Don’t let these documents pile up — turn them into insights.

| Ready to Simplify EOBs and Boost Revenue? At A2Z Medical Billing, we don’t just post payments — we decode your EOBs, catch underpayments, and ensure you’re paid every dollar you deserve. Whether you’re dealing with denied claims, unexplained adjustments, or payer chaos, our experts are here to help. – 98% claim accuracy rate – Real-time denial tracking and appeals – Seamless EOB & ERA posting workflows – Personalized reporting and financial transparency Let us turn your EOBs into income. Talk to Our Billing Expert |

Frequently Asked Questions (FAQs)

Is the EOB the same as a patient invoice?

No. The EOB in medical billing explains what the insurance has paid. The invoice is what the provider sends for patient payment.

Can providers dispute what’s listed in an EOB?

Absolutely. You can appeal any underpayments or denials using the information and codes on the EOB.

How long should I keep EOBs?

Most experts recommend keeping EOBs for at least 7 years, especially for Medicare-related claims.

Why did the insurance pay less than what I billed?

This often happens due to negotiated contract rates, deductibles, or coverage limitations.

Do I need both ERA and EOBs?

Yes. ERAs are for automated processes, but EOBs (especially printed) can be helpful for audits and cross-verification.