In medical billing, three letters can save your practice thousands of dollars — ABN.

Ask any provider who’s been audited or had a Medicare denial pile up on their desk, and they’ll tell you the same story: “If only we had issued an ABN.”

The Advance Beneficiary Notice of Noncoverage (ABN) isn’t just a piece of paperwork CMS makes you use.

It’s a tool that protects your revenue, ensures your billing compliance, and, most importantly, provides patients with clarity about their financial responsibility.

The problem is, many practices either don’t know when to use it, use it incorrectly, or treat it like a checkbox without explaining it to patients.

This complete guide is here to change that. We’ll delve into what the ABN actually is, when and how to use it, how it relates to appeals, and the real-world mistakes providers make that ultimately cost them. By the end, you’ll see the ABN not as red tape but as part of your revenue cycle defense system.

What is an ABN in Medical Billing?

The ABN, or Advance Beneficiary Notice of Noncoverage, is a standardized form that Medicare providers give to patients before delivering a service that Medicare may not cover.

Think of it as a financial warning label. Just like a medicine bottle warns you about side effects, the ABN advises patients: “Medicare might not pay for this. If they don’t, you’ll be responsible.”

Let’s say a 74-year-old woman visits her primary care physician for a routine check-up. She asks for a screening vitamin D test. The physician knows that Medicare only covers that test if the patient has a documented deficiency or risk factors, such as osteoporosis. Without medical necessity, Medicare will deny the claim.

At this moment, the ABN comes into play. The provider hands the patient an ABN explaining:

- Why Medicare may not pay.

- What the test costs (e.g., $80–$120).

- That she can still choose to have it done and accept financial responsibility.

If the patient signs the ABN, the provider is protected from liability. If not, and the provider skips the ABN, the denial is returned, and the provider must bear the cost.

That’s the difference between staying compliant and losing money.

What Does an ABN Actually Do?

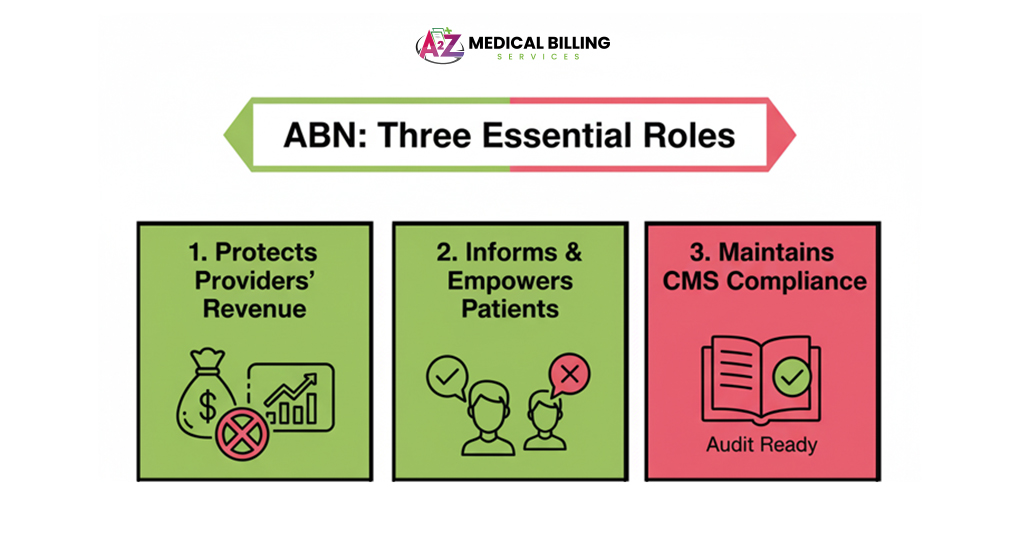

On the surface, the ABN appears to be a formality. But in practice, it plays three important roles:

1. Protects Providers’ Revenue

Without an ABN, you can’t bill the patient if Medicare denies the claim. That’s it. You lose the money. With an ABN, you shift the financial responsibility to the patient if Medicare says no.

Scenario:

- You perform a second bone density scan in a year.

- Medicare only covers one every 24 months unless medical necessity is documented.

- Without an ABN, the claim is denied; the provider writes off $150.

- With ABN: Claim denied, patient responsible.

Multiply that by dozens of patients per year, and you see why skipping ABNs destroys revenue.

2. Informs and Empowers Patients

Patients don’t like surprise bills. By presenting an ABN, you give them the information to decide whether they want the service or not. They can:

- Proceed and accept possible out-of-pocket costs.

- Decline and avoid the financial risk.

- Ask you to bill Medicare anyway (and keep appeal rights).

It’s about transparency, not just compliance.

3. Maintains CMS Compliance

Medicare requires providers to notify patients when coverage is questionable. Issuing an ABN keeps you on the right side of CMS guidelines. In an audit, an ABN in the chart is solid proof that you followed the rules.

ABN and Appeals: The Connection

ABNs aren’t just about billing — they’re also about appeals.

If a patient signs an ABN and chooses the option to “bill Medicare anyway,” Medicare will process the claim even if it’s likely to be denied. If denied, the patient receives a denial notice, which gives them the right to appeal.

Why This Matters

Without an ABN, patients may not have the option to appeal. That means they lose a layer of protection, and you, as the provider, may be held responsible for noncompliance.

Here’s a scenario:

- A patient requests a preoperative screening EKG.

- The provider issues an ABN because the test may not be covered as a preventive service.

- Patient opts to bill Medicare anyway.

- Medicare denies the patient’s appeal, but the appeal is granted because the test was medically justified for surgical clearance.

- Outcome: Medicare pays, patient satisfied, provider compliant.

That chain of events is only possible because the ABN existed.

When Should a Provider Issue an ABN?

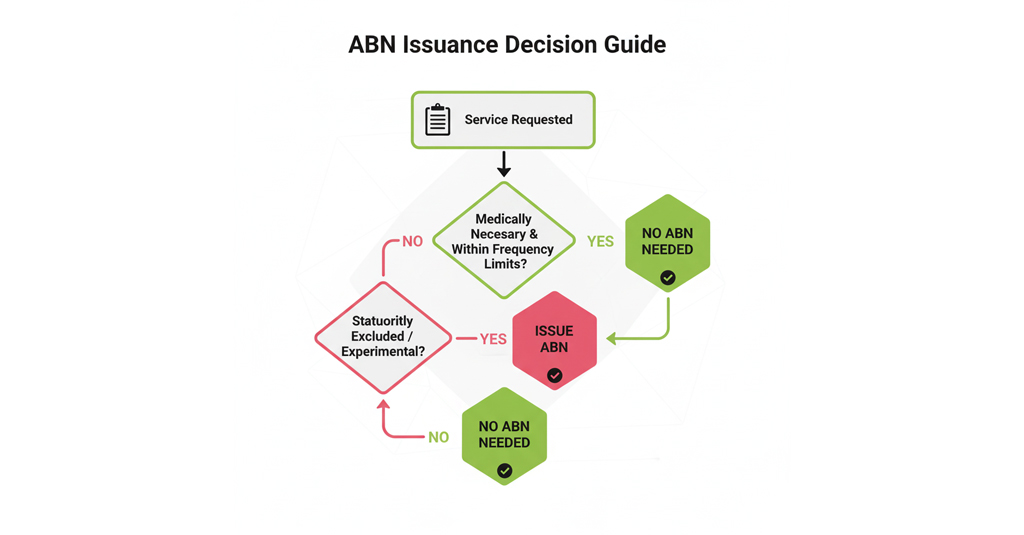

This is the million-dollar question. CMS doesn’t want you issuing ABNs for everything — only when there’s a reasonable belief that Medicare may deny coverage.

Here are the most common triggers:

Medically Unnecessary Services

- Lab tests are ordered too frequently.

- Screening exams repeated outside coverage limits.

- Imaging was done without proper medical justification.

Example: Ordering an HbA1c test every month for a stable diabetic patient. Medicare covers it quarterly, not monthly.

Frequency Limitations

Medicare sets limits for how often services can be performed.

- Bone density scans: every 24 months.

- Screening colonoscopy: once every 10 years (or every 2 years if high risk).

- Pap smears: every 24 months.

Any service outside these limits requires an ABN.

Statutorily Excluded Services

Some services are never covered by Medicare, such as:

- Routine dental cleanings.

- Cosmetic surgery.

- Hearing aids.

- Routine foot care.

In these cases, ABNs are often issued voluntarily to notify patients of their financial responsibility.

Experimental or Research-Based Services

If a procedure is investigational or not FDA-approved, Medicare will likely deny. The ABN warns the patient upfront.

Durable Medical Equipment (DME)

Wheelchairs, CPAP machines, and home oxygen therapy often require strict medical necessity criteria. If criteria aren’t met, issue an ABN.

Key Rule: ABNs must always be given before the service is performed. Handing it after is like locking the barn door after the horse has bolted.

Key Components of a Valid ABN

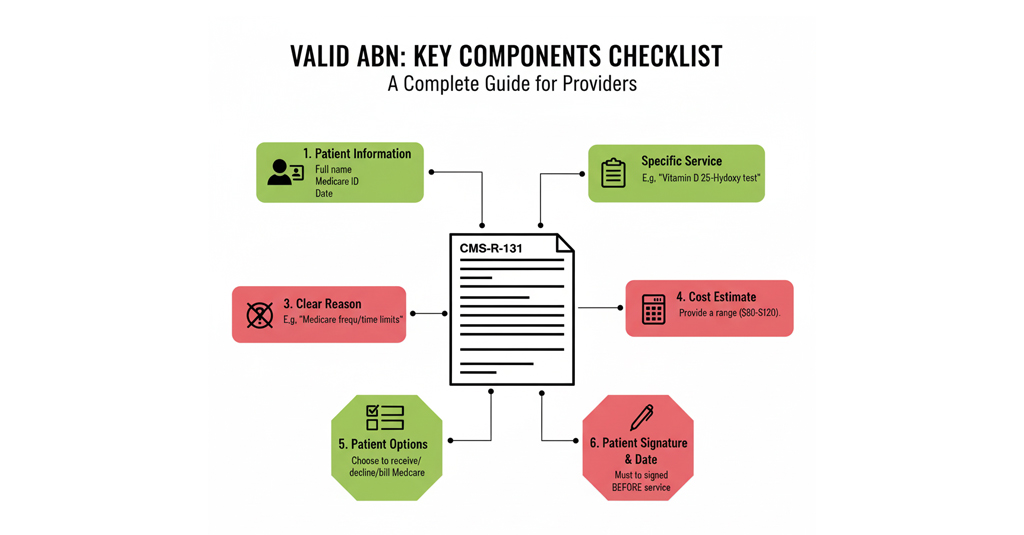

Not all ABNs are created equal. For Medicare to accept one, it must include all required elements. Missing even one can render the form invalid.

Here’s what every ABN needs:

- Patient Information

Full name, Medicare number, date. - Description of Service or Item

Must be specific. Instead of “blood test,” say “Vitamin D 25-Hydroxy test.” - Reason for Possible Denial

Clear explanation in plain language. For example:

“Medicare does not cover this test when performed more than once every 12 months.”

- Estimated Cost

Give a ballpark figure ($150–$200). Patients need to know what they’re agreeing to. - Options Section

Patients must choose one:- Bill Medicare, accept responsibility if denied.

- Pay out of pocket, don’t bill Medicare.

- Decline service.

- Signature and Date

The patient must sign and date before receiving the service.

If any of these elements are missing, the ABN is invalid, and you may not bill the patient.

Common Mistakes Providers Make with ABNs

Even the most experienced providers and billers misstep when it comes to ABNs. The form looks simple, but CMS rules make it a compliance landmine if not handled correctly. Let’s look at the most common errors and — more importantly — how to avoid them.

Using Vague Service Descriptions

Writing generic phrases like “lab test” or “therapy session.” CMS requires the service to be clearly described. A vague ABN is treated as if it had never been issued.

Example: Instead of “lab work,” write “Thyroid-stimulating hormone (TSH) blood test.”

How to avoid it:

- Always list the exact test, procedure, or item that may be denied.

- Use the same terminology that appears in your EMR, orders, or CPT/HCPCS codes.

- Train front-desk staff and nurses to double-check that the ABN matches the ordered service.

Not Providing a Cost Estimate

Leaving the “Estimated Cost” blank or writing “TBD.” Patients then feel blindsided when they receive a $400 bill weeks later.

CMS requirement: You must give a reasonable estimate — not exact to the penny, but close enough to guide the patient’s decision.

How to avoid it:

- Use your billing system to pull the usual charge for the service.

- If the cost can vary (e.g., different panels of lab tests), list a range (e.g., $150–$250).

- Always explain verbally that it’s an estimate, but give them a real number on paper.

Forcing Patients to Sign

Staff sometimes say, “You must sign this, or we can’t do your procedure.” That’s considered coercion, which CMS forbids. A coerced ABN is invalid.

If the patient complains to Medicare, you could face compliance trouble.

How to avoid it:

- Train staff to use neutral language like: “Medicare may not cover this test. This form lets you decide if you’d still like to receive it and pay if denied.”

- Document in your EMR if the patient refused to sign or declined the service.

- Never suggest that care will be withheld if they don’t sign.

Issuing the ABN Too Late

Handing the form to the patient after the service (e.g., after drawing labs or performing an MRI). CMS refers to this as a “retroactive ABN,” which is invalid.

How to avoid it:

- Integrate ABN checks into your eligibility verification workflow.

- Flag high-risk services (like DME, screening tests outside frequency limits, or non-covered therapies) before scheduling or at check-in.

- Make ABN issuance part of the pre-service checklist, just as you would with consent forms.

Using the Wrong Form

The mistake: Some practices design their own waiver or use outdated versions of the ABN. Unless it’s the official CMS-R-131, it won’t hold up in an audit.

How to avoid it:

- Always download the latest ABN form from the CMS website.

- Update your forms library at least once a year to ensure compliance.

- Train staff to recognize the correct form layout (logo, OMB approval number, etc.).

Not Keeping a Copy

The patient gets their signed ABN, but the office forgets to scan or file a copy. Months later, when Medicare denies and you appeal, you have no proof.

How to avoid it:

- Create a scanning protocol: every signed ABN must be scanned into the EMR within 24 hours.

- For paper charts, keep a separate binder organized by patient and date, labeled with the ABN.

- During audits, always be prepared to produce ABNs quickly — CMS frequently tests record-keeping.

Each of these mistakes creates either a compliance hole or a revenue leak. Avoiding them requires workflow integration, staff training, and a disciplined approach to documentation. Think of the ABN not as “just a form,” but as a legal shield that protects both your practice and your patient relationships.

ABN in Billing Process

It’s easy to think of the ABN as a standalone task: hand the patient a form, check a box, and move on. But that mindset is what creates revenue leakage. In reality, the ABN is one gear in the larger revenue cycle management (RCM) machine. If you miss this step, the whole engine sputters.

Here’s how the ABN fits into the billing flow:

Eligibility and Coverage Check

Your front desk or billing staff starts by verifying Medicare coverage for the patient’s upcoming service. This is where the red flags appear—such as a patient requesting a fourth physical therapy session this week, when Medicare typically only covers three.

Identify Potential Denial

If the service has a high chance of denial, flag it early. Consider options such as screening colonoscopies beyond the recommended frequency or experimental therapies. The sooner you know, the smoother your ABN conversation will be.

ABN Issuance

This is the heart of it. Sit down with the patient, explain why Medicare may not cover the costs, and outline their financial responsibility. Provide them with a cost estimate, review their options, and, most importantly, answer any questions they may have. Rushed ABN conversations lead to complaints later.

Service Delivery

Now you provide the care—lab, imaging, equipment, or therapy. By this point, the patient has decided whether they’ll pay out of pocket if Medicare denies coverage.

Claim Submission

Here’s where coding comes into play. If you issued an ABN, you must use the correct modifier when filing the claim. For example:

- GA: ABN on file, Medicare may deny.

- GX: Voluntary ABN (service never covered).

Mess this up, and your claim may bounce back even if the ABN was valid.

Medicare Decision

Medicare processes the claim. If they approve, great—your ABN becomes irrelevant. If they deny, your documentation and ABN protect you.

Appeal or Patient Responsibility

The outcome depends on the patient’s selection of ABN. If they agreed to pay if denied, you can bill them. If they choose not to receive the service, you avoid unnecessary costs. If they want to appeal, the ABN proves they were informed.

Skipping step 3 (ABN issuance) is where most practices lose money. Everything before and after depends on it. Without the ABN, denied claims turn into uncollectible balances, and you’re left arguing with a frustrated patient.

ABNs are your safety net in RCM. Without them, you’re walking the tightrope of Medicare billing with no protection when claims fall through.

What Patients Should Do When Receiving an ABN

From the patient’s perspective, the ABN can feel intimidating. Suddenly, they’re faced with a form that says, “Medicare may not pay.” Here’s what they should do:

- Ask questions: “Why might Medicare deny this?”

- Understand the cost estimate: Is it $50 or $500? That matters.

- Weigh the risk: Is the service urgent or optional?

- Keep a copy: Always keep a signed copy for personal records.

Providers should take a moment to explain the form in plain English. A rushed, unclear ABN conversation creates mistrust. A thoughtful explanation builds confidence.

ABNs According to Payers

ABNs are Medicare-specific, but other payers have their own versions:

- Medicare: Mandatory in certain situations, standardized form.

- Medicaid: Does not use ABNs, but many states require their own “Notice of Noncoverage” or liability forms.

- Commercial Insurance: Many plans require a “waiver of liability” or prior authorization forms. Always check contract terms.

Providers must train staff to recognize payer-specific rules. Using an ABN for a Blue Cross patient, for example, will not be accepted.

Best Practices to Avoid Revenue Loss with ABNs

- Be proactive: Don’t wait until denials pile up—train staff to recognize ABN situations.

- Explain clearly: Patients should never feel pressured or tricked into signing.

- Always include a cost estimate: Transparency reduces complaints.

- Use the correct modifiers: GA, GX, GY, GZ — these flags indicate Medicare about ABNs and liability.

- Document thoroughly: A missing ABN can cost you more than the service itself.

- Role-play training: Practice with staff on how to explain ABNs in a way that doesn’t scare patients.

- Review patterns: If you’re issuing ABNs too frequently for the same service, consider tightening your coding or documentation.

Final Thoughts

The ABN isn’t just about compliance — it’s about protection and trust. For providers, it ensures you don’t take on unnecessary financial risk. For patients, it gives clarity and choice. For Medicare, it creates accountability.

Providers who master ABN usage don’t view it as extra paperwork. They see it as part of their billing toolkit — a safety net that keeps revenue flowing, patients informed, and audits less stressful.

When in doubt, issue an ABN. It’s better to explain coverage uncertainty upfront than to send a surprise bill later.

FAQs

Do I need an ABN for every Medicare service?

No. ABNs are only required when you reasonably expect Medicare may deny coverage for a service—for example, routine foot care, some lab tests outside frequency limits, or experimental procedures. If a service is always covered, no ABN is needed. If a service is never covered, you may use a voluntary ABN.

Can I issue an ABN after providing the service?

No. CMS is strict about timing. An ABN must be presented and signed before the service is delivered. Suppose you submit the form after the patient has already undergone their blood test, imaging, or therapy session. In that case, the form is invalid, and you’ll be financially responsible if Medicare denies the claim.

Do ABNs apply to Medicaid or commercial insurance?

No. ABNs are Medicare-specific forms. That said, Medicaid and many commercial insurers use their own versions of financial responsibility notices. For example, some payers require “waivers of liability” or advance cost estimates. Best practice is to check each payer’s policy.

What happens if I don’t issue an ABN and Medicare denies?

In that case, you cannot legally bill the patient. The financial liability stays with your practice, even if the service was clearly non-covered. That’s why skipping the ABN step often results in lost revenue and unpaid claims.

How long should I keep ABNs on file?

CMS recommends keeping ABNs for at least 5 years from the date of service, or longer if your practice is under ongoing audits or has open appeals. This ensures you can provide documentation quickly if Medicare requests it during a review.

Can patients refuse to sign an ABN?

Yes. Patients can refuse. If they decline to sign, document their refusal in your EMR or chart. Then, you must decide whether to proceed with the service at your own financial risk or to defer the service until coverage questions are resolved.

What modifiers go with ABNs?

Correct modifiers are essential for clean claims:

- GA: ABN on file, patient informed, expecting denial.

- GX: Voluntary ABN issued for non-covered services.

- GY: Statutorily excluded service (Medicare never covers it).

- GZ: No ABN issued, provider expects denial (basically waving liability).