Insurance verification sits at the very front of the revenue cycle. Yet, it remains one of the most misunderstood steps in medical billing. Many practices still treat it as a quick checkbox task. That approach costs money. It also strains staff and frustrates patients.

I have seen clean claims denied for one simple reason. Coverage was not verified correctly. A missing authorization. A plan exclusion. An inactive policy. Each one leads to rework, delays, and lost revenue.

This guide explains insurance verification from the ground up. It follows real workflows used in U.S. practices. It reflects payer rules. And it focuses on what actually protects reimbursement. Let’s walk through it step by step.

Insurance Verification in Healthcare

Insurance verification is the process of confirming a patient’s coverage details before services are provided. It answers one core question.

Will this payer cover this service for this patient on this date?

That sounds simple. In practice, it is layered. Coverage depends on plan type, effective dates, benefits, medical necessity, and payer-specific policies. A patient may have active insurance but no coverage for the scheduled service.

According to MGMA data, nearly 75% of claim denials are linked to front-end errors, with eligibility and coverage issues ranking highest. That tells a clear story. Verification is not clerical work. It is revenue protection.

Verification also sets expectations. When patients know their financial responsibility upfront, collections improve. Practices that provide cost transparency see patient payment rates rise by 20–30%, based on HFMA benchmarks.

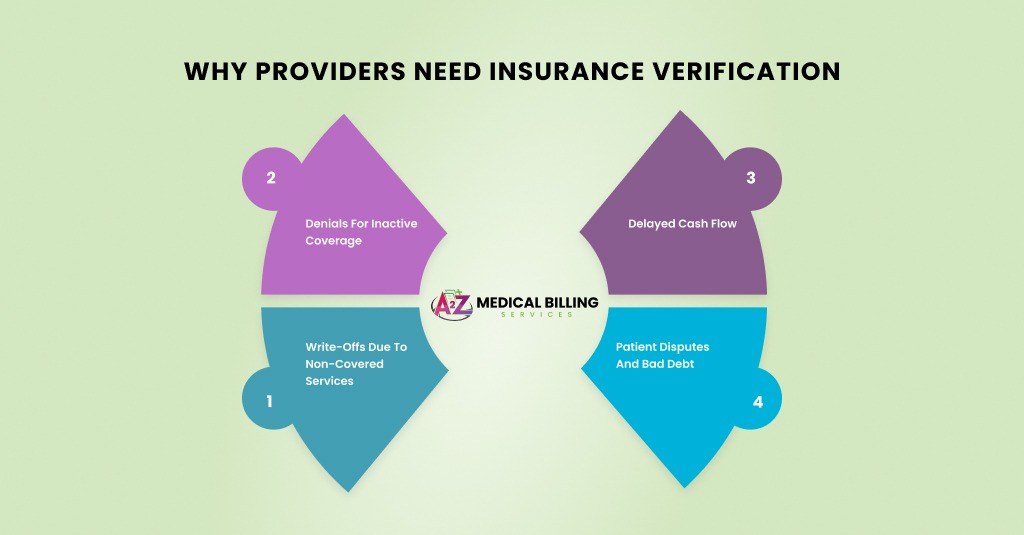

Why Providers Need Insurance Verification

Healthcare plans have become more complex. High-deductible health plans now cover over 55% of privately insured patients in the U.S. That changes how benefits apply. Coverage does not mean payment.

Payers also enforce stricter preauthorization rules. Medicare Advantage plans, in particular, require detailed checks even for services that traditional Medicare covers at no cost.

Without proper verification, practices face:

- Denials for inactive coverage

- Write-offs due to non-covered services

- Delayed cash flow

- Patient disputes and bad debt

A strong verification process prevents these issues before they start. It keeps the revenue cycle moving instead of constantly fixing mistakes.

Key Information Needed Before Verifying Coverage

Insurance verification starts long before anyone logs into a payer portal or picks up the phone. It begins with collecting the correct information. Miss one detail here, and the entire verification process weakens. I have seen fully covered services denied simply because a demographic field did not match the payer record. That is how sensitive this step is.

Consider this phase as laying the foundation. If the foundation is shaky, everything that follows will crack. Strong verification depends on accuracy, timing, and context.

Key information required before verifying insurance coverage includes:

- Patient’s full legal name, date of birth, and gender as listed on the insurance record, not nicknames or shortened versions, to avoid eligibility mismatches during real-time checks.

- Current patient address and contact details, since some payers use address validation as part of their eligibility confirmation process.

- Insurance payer name and plan name, entered exactly as shown on the insurance card, to ensure claims and eligibility requests route correctly.

- Member ID and group number, including any alpha prefixes, because missing or incorrect characters often send claims to the wrong payer system.

- Front and back copies of the insurance card, as the back provides payer IDs, authorization phone numbers, and claims submission instructions.

- Policyholder’s name, date of birth, and relationship to the patient, especially for dependent coverage under employer-sponsored or family plans.

- Type of insurance plan, such as PPO, HMO, Medicare Advantage, Medicaid managed care, or commercial marketplace plans, since coverage rules vary widely by plan type.

- Scheduled date of service, because eligibility and benefits are always date-specific and can change without notice.

- Reason for visit and expected services, including anticipated CPT or HCPCS codes, to properly check coverage limits, exclusions, and authorization requirements.

- Rendering provider and practice location details, including NPIs, to confirm in-network status and avoid network-related denials.

- Referral or prior authorization history, when applicable, to confirm remaining visits, valid approval dates, and authorized units.

Collecting this information before verification may feel time-consuming at the front desk, but it prevents far bigger problems later. Clean intake data turns insurance verification into a revenue-protecting process instead of a denial-cleanup task.

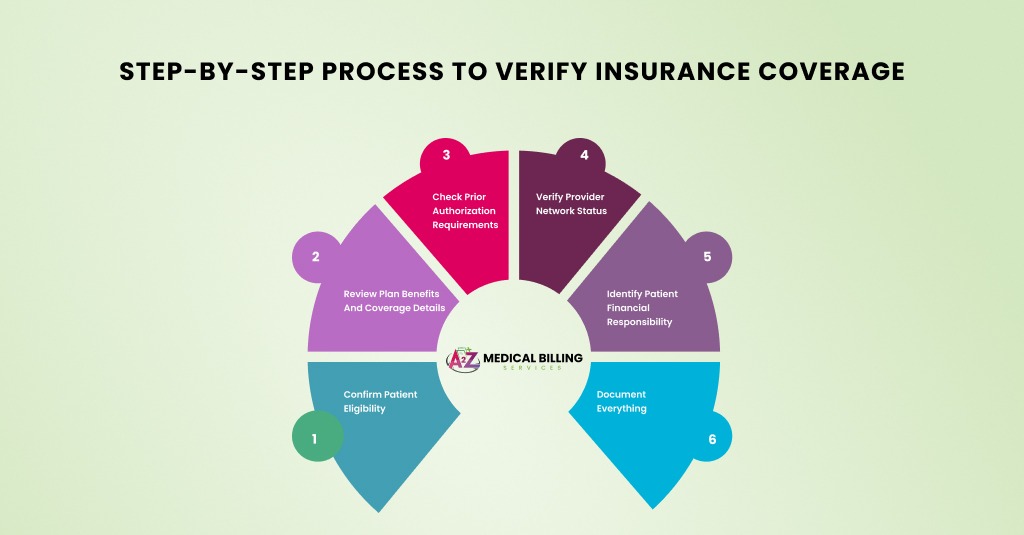

Step-by-Step Process to Verify Insurance Coverage

A reliable process keeps verification consistent across staff and locations. Let’s break it down in real-world terms.

Step 1: Confirm Patient Eligibility

Eligibility verification confirms whether the policy is active on the date of service. This step also identifies the payer order when multiple plans exist.

Use real-time eligibility tools through your practice management system or clearinghouse. For Medicare, verify through the Medicare Eligibility tools. For Medicaid, check state-specific portals.

Always confirm:

- Effective and termination dates

- Plan type

- Primary vs secondary status

An active plan today does not guarantee active coverage next week. That is why timing matters.

Step 2: Review Plan Benefits and Coverage Details

Eligibility alone is not enough. Benefits determine what the plan will pay.

At this stage, confirm:

- Covered services

- Copay, coinsurance, and deductible

- Out-of-pocket maximum status

For example, a patient may have coverage for physical therapy but be limited to 20 visits per year. If the limit is reached, services become the patient’s responsibility.

Medicare follows national and local coverage determinations. Commercial plans rely on internal medical policies. Both require attention.

Step 3: Check Prior Authorization Requirements

Prior authorization is one of the most common denial triggers. Many plans require approval before services are rendered.

Authorization rules vary by:

- CPT or HCPCS code

- Diagnosis

- Place of service

- Provider type

Medicare traditional rarely requires prior authorization, but Medicare Advantage plans do. Commercial plans are almost always used for imaging, procedures, and therapies.

If authorization is required, document the reference number, approval dates, and authorized units. Store this information in the patient record.

Step 4: Verify Provider Network Status

Network status affects reimbursement and patient cost. An out-of-network provider can result in reduced or no payment.

Confirm that:

- The rendering provider is in-network

- The billing provider is in-network

- The payer recognizes the location

This step is critical for group practices with multiple NPIs and locations.

Step 5: Identify Patient Financial Responsibility

Once the coverage details are clear, calculate the patient’s responsibility. This includes copays, deductibles, and coinsurance.

High-deductible plans often leave patients responsible for the full allowed amount until the deductible is met. Inform patients upfront. Transparency reduces payment disputes later.

Many practices collect estimated balances at check-in. This improves cash flow and reduces billing costs.

Step 6: Document Everything

Verification without documentation does not protect the practice. Always record:

- Date and time of verification

- Payer contact or portal used

- Representative name or reference number

- Details discussed

This documentation supports appeals if a payer later denies the claim.

Insurance Verification by Payer Type

Each payer category follows different rules. Understanding these differences prevents costly mistakes.

Medicare Insurance Verification

Traditional Medicare verification focuses on eligibility and coverage under Parts A and B. Coverage is generally straightforward, but medical necessity rules apply.

Local Coverage Determinations outline when services are covered. Diagnoses must support the service billed. Documentation must reflect medical necessity clearly.

Medicare Advantage plans act more like commercial insurance. They require benefit checks, authorizations, and network confirmation.

Medicaid Insurance Verification

Medicaid rules vary by state. Eligibility can change monthly. Verification must occur close to the service date.

Some states require service-specific authorizations. Others limit visits annually. Always check state Medicaid portals and managed care plan policies.

Commercial Insurance Verification

Commercial plans are the most complex. Each payer has multiple products with different rules.

Always confirm:

- Employer-based vs individual plan

- In-network benefits

- Policy exclusions

Commercial payers also change policies frequently. Relying on old information invites denials.

Insurance Verification Mistakes and How to Avoid Them

Below are the most common insurance verification mistakes and practical ways to prevent them in day-to-day operations.

Verifying eligibility but ignoring benefit details

One of the biggest mistakes is stopping at eligibility confirmation. Staff see an “active” status and move on, assuming the service will be covered. Active coverage only means the policy exists. It does not confirm whether the scheduled service is included, limited, or excluded.

To avoid this, always review benefit details for the specific service. Check deductibles, copays, coinsurance, visit limits, and exclusions. Make benefits review a required step, not an optional one.

Failing to check prior authorization requirements

Prior authorization errors remain one of the top denial reasons across commercial and Medicare Advantage plans. Many practices assume authorization is only needed for major procedures or imaging. In reality, therapies, injections, and even office-based services may require approval depending on the plan.

The solution is to verify authorization rules using CPT codes and the planned diagnosis. Document approval numbers, dates, and authorized units clearly in the patient record.

Not re-verifying insurance for follow-up visits.

Insurance coverage changes more often than patients expect. Employers change plans, Medicaid eligibility fluctuates monthly, and marketplace policies update frequently. Relying on old verification data is risky.

Re-verify insurance before every visit, especially for recurring appointments. A quick eligibility check protects the practice from avoidable denials.

Ignoring the provider and location network status

Many practices verify patient coverage but forget to confirm network status for the rendering provider or service location. This leads to out-of-network denials or reduced reimbursement.

To prevent this, confirm that both the billing provider and rendering provider are in-network for the specific plan and location. This step is critical for group practices and multi-location clinics.

Using outdated or incomplete insurance card information

Patients often present old insurance cards without realizing their plan has changed. Missing group numbers, incorrect payer names, or absent prefixes cause eligibility errors and claim misrouting.

Avoid this by collecting a fresh copy of the insurance card at every visit. Review both the front and back for accuracy before starting verification.

Skipping documentation of verification details

Even when verification is done correctly, failing to document it leaves the practice unprotected. If a payer later denies the claim, there is no proof of what was confirmed.

Always record the date and time of verification, the payer source used, reference numbers, and any representative names. This documentation strengthens appeals and supports compliance.

Assuming Medicare Advantage works like traditional Medicare

This mistake has become more common as Medicare Advantage enrollment grows. Many staff treat these plans as standard Medicare, skipping benefit checks and authorization reviews.

Medicare Advantage plans follow commercial-style rules. Always verify benefits, network status, and authorization requirements separately from traditional Medicare.

Not communicating patient responsibility upfront.

When verification is done silently, and patients are not informed of their financial responsibility, disputes arise after the visit. This leads to delayed collections and patient dissatisfaction.

Avoid this by clearly communicating copays, deductibles, and estimated balances before the visit. Transparency builds trust and improves payment rates.

Get Faster Insurance Coverage Verification Faster with A2Z

Insurance verification demands time, payer knowledge, and precision. A2Z Medical Billing Services helps practices handle this critical step with confidence.

Our team verifies eligibility, benefits, authorizations, and network status before services are rendered. We document every detail and flag risks early. This protects revenue and improves patient experience.

With A2Z Billing, practices reduce claim denials, speed up payments, and free staff from constant follow-ups. Verification becomes a strength, not a bottleneck.

Frequently Asked Questions

What is the difference between eligibility and coverage verification?

Eligibility verification confirms that an insurance policy is active on the date of service and identifies the payer. Coverage verification goes several steps further. It determines whether a specific service is covered, what limitations apply, and whether prior authorization or referrals are required. Without coverage verification, an active policy can still result in a denied claim.

How often should insurance be verified?

Insurance verification should be performed before every patient visit, including for established patients. Plans change frequently due to employer updates, Medicaid renewals, or policy terminations. Verifying each time ensures the information is up to date and reduces the risk of billing for a service under outdated coverage details.

Does insurance verification guarantee payment?

Insurance verification lowers denial risk, but it does not guarantee reimbursement. Claims must still meet payer requirements for correct coding, accurate documentation, and medical necessity. If any of these elements are missing, a verified claim can still be denied or underpaid.

Who is responsible for insurance verification in a practice?

Insurance verification is typically handled by front-desk staff, billing teams, or revenue cycle specialists. In many practices, this responsibility is outsourced to experienced billing companies to maintain consistency, reduce staff burden, and improve accuracy across all payer types.

What happens if insurance is not verified correctly?

When verification is incomplete or incorrect, claims are often denied or delayed. This leads to increased write-offs, patient billing disputes, and additional follow-up work for staff. Over time, poor verification directly impacts cash flow and patient satisfaction.

Can insurance verification be automated?

Eligibility checks can be automated using clearinghouses and payer portals. However, benefit review, authorization requirements, and network status still require human oversight. Automation works best when combined with experienced review to catch payer-specific rules and exceptions.