Medical billing requires the attention of healthcare providers. One wrong step and reimbursement slips away. Among all CPT and HCPCS categories, J-codes cause the most confusion and denials. Providers administer expensive drugs every day. Yet many practices still struggle to get paid correctly for them.

J-codes in medical billing are not just numbers. They represent authentic medications, real costs, and real compliance risks. When billed correctly, they protect revenue. When billed wrong, they invite audits, recoupments, and delayed payments.

This guide explains J-codes, the billing process, payer rules, and common errors to avoid.

What are J-Codes in Medical Billing?

J-codes are part of the HCPCS Level II code set. They identify injectable drugs, infused medications, and some non-oral chemotherapy agents that are usually administered in a clinical setting.

Most J-codes start with the letter “J”, followed by four numbers. For example, J1745 represents infliximab. J3490 represents an unclassified drug.

These codes exist because CPT codes alone cannot describe medications. Drugs require different tracking. They involve dosage, wastage, and cost reporting. That is where J-codes step in.

From a billing standpoint, J-codes often represent the highest dollar line item on a claim. In oncology, rheumatology, gastroenterology, and infusion centers, drug reimbursement can exceed professional fees by ten times or more.

According to CMS data, Part B drug spending exceeds $37 billion annually, and J-codes account for the majority of it. That alone explains why payers scrutinize them so closely.

Each J-code includes a specific description that defines:

• The drug name

• The strength or unit measurement

• The route of administration

For example, many J-codes are billed per unit, such as 1 mg, 10 mg, or 100 units. This detail matters. A simple math error can cut reimbursement in half.

CMS updates J-codes quarterly. New drugs receive temporary codes. Some move from C-codes to J-codes. Others expire. Staying updated is not optional. It is survival.

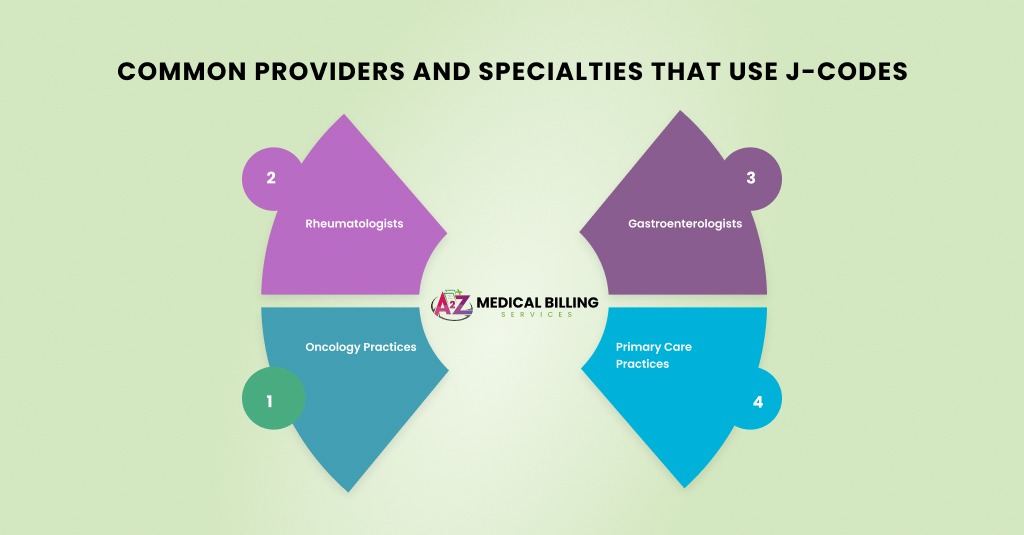

Common Providers and Specialties That Use J-Codes

J-codes are not limited to one specialty. They appear across outpatient and physician-administered services.

- Oncology practices use them daily for chemotherapy and supportive drugs.

- Rheumatologists rely on them for biologics.

- Gastroenterologists bill J-codes for infusion therapies. Pain management clinics use them for injectables.

- Even primary care practices encounter them with vaccines and therapeutic injections.

Any provider who buys and administers drugs must understand J-code billing. Otherwise, revenue leaks slowly and quietly.

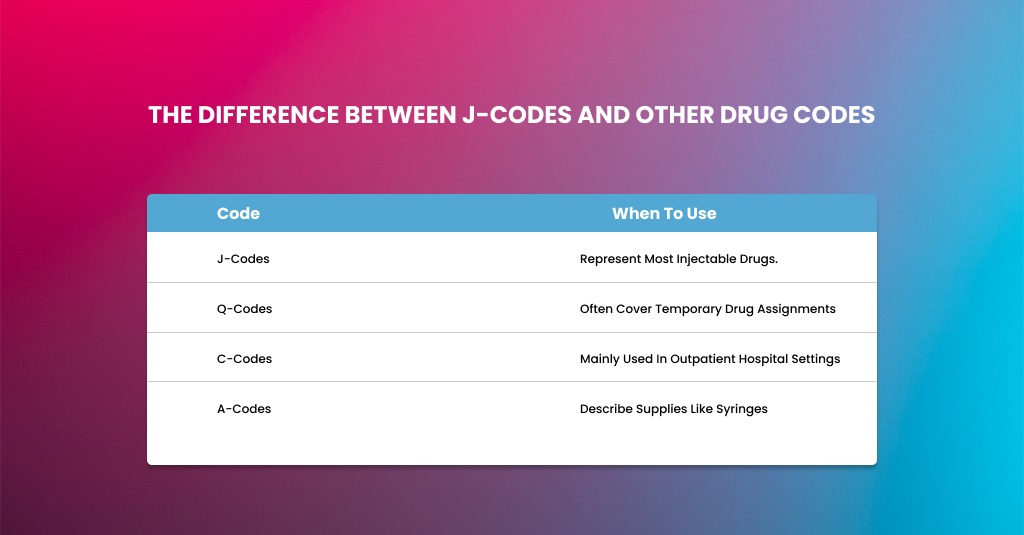

The Difference Between J-Codes and Other Drug Codes

Providers often mix J-codes with other HCPCS codes. That creates billing chaos.

J-codes represent most injectable drugs.

Q-codes often cover temporary drug assignments.

C-codes are mainly used in outpatient hospital settings.

A-codes describe supplies like syringes.

Knowing which code applies depends on the site of service, payer, and drug classification. Medicare may allow a J-code, while a commercial payer demands an NDC-only submission.

This is where payer rules quietly override general coding logic.

The Role of NDC Numbers in J-Code Billing

A J-code alone is rarely enough. Payers want NDC numbers to verify the exact drug used.

The NDC identifies the manufacturer, product, and package size. It tells the payer what you actually purchased.

Most payers require:

- The 11-digit NDC

- Correct unit conversion

- Quantity administered

- Measurement qualifier (ML, UN, GR)

A mismatch between J-code units and NDC units is one of the top causes of drug claim denials.

Industry studies show that over 40% of drug claim denials stem from NDC errors. That is lost money sitting on the table.

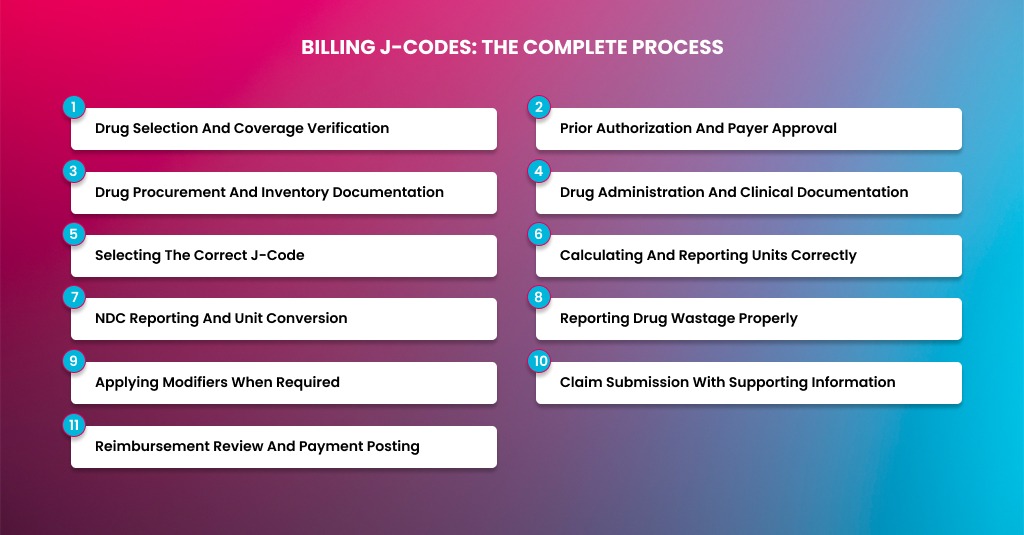

Billing J-Codes: The Complete Process

Billing J-codes is not a single task. It is a chain of events that starts before the drug is ordered and ends only when the correct payment lands in your account. Miss one step, and the whole chain weakens. That is why many providers feel frustrated with drug billing, even when clinical care is flawless.

J-codes represent some of the highest-cost items in outpatient billing. They attract payer scrutiny. They trigger audits. They generate denials faster than almost any other code category. Yet when the process is handled correctly, J-codes become one of the most stable revenue streams in a practice.

Let’s break down the complete J-code billing process, step by step.

Drug Selection and Coverage Verification

The J-code billing process starts before the drug touches the patient. This is where many practices already fall behind.

Every drug has coverage rules. Some are universally covered. Others depend on diagnosis, disease stage, or prior therapy. Medicare rules differ from Medicaid. Commercial plans add their own layers.

Coverage verification should confirm:

• The patient’s plan covers the drug

• The diagnosis supports medical necessity

• Prior authorization is required or not

• Site-of-care restrictions apply

Administering a drug first and checking coverage later is risky. If prior authorization was required and not obtained, many payers will deny the claim outright with no appeal option.

Prior Authorization and Payer Approval

Many J-code drugs require prior authorization, especially biologics, chemotherapy agents, and specialty infusions. This step protects both the provider and the patient.

Authorization requests must match exactly what will be billed. That includes:

• Drug name and J-code

• Dosage and frequency

• Diagnosis and clinical justification

• Place of service

If the administered dose differs from the approved dose, payment can be reduced or denied. Even small deviations raise red flags.

Best practice is to store authorization details centrally and make them visible to both clinical and billing teams. Disconnected workflows cause mistakes.

From an RCM standpoint, practices that integrate authorization checks into scheduling see significantly lower denial rates than those that handle it after the fact.

Drug Procurement and Inventory Documentation

Once coverage is confirmed, the drug is ordered. This step directly affects billing compliance.

Payers expect providers to bill only for drugs they actually purchased. That is why invoices and acquisition records matter.

Inventory documentation should include:

- Purchase date

- Drug name and strength

- NDC number

- Quantity purchased

- Lot number and expiration

This data supports billing accuracy and protects you during audits. For Medicare, ASP-based reimbursement assumes legitimate acquisition.

OIG audits repeatedly cite poor drug inventory controls as a reason for recoupments. Clean records reduce risk.

Drug Administration and Clinical Documentation

Administration is where clinical care and billing intersect. What is documented here determines how the claim is built.

Clinical notes must clearly state:

- Drug administered

- Total dose given

- Route and method

- Start and stop times, if applicable

- Any drug discarded

Vague language causes billing confusion. “Partial vial used” is not enough. The exact amount administered and the amount wasted must be documented.

For infused drugs, start and stop times support not only J-codes but also infusion CPT codes. Incomplete notes lead to denials or downcoding.

Strong documentation is your first defense against audits.

Selecting the Correct J-Code

After administration, coding begins. This step looks simple, but it carries a high risk.

Each J-code has a specific descriptor that defines the unit of measure. Billing the wrong code or misunderstanding the unit definition results in underpayment or denial.

For example, one J-code may represent 1 mg, while another represents 10 mg. Coding staff must calculate total units based on what was actually administered.

CMS updates HCPCS codes quarterly. New drugs receive temporary codes. Others are replaced or deleted. Coding accuracy depends on staying current.

From experience, unit errors remain the number one J-code billing mistake across all specialties.

Calculating and Reporting Units Correctly

Unit calculation is where math meets money. One wrong calculation can cost thousands.

The process should follow this flow:

- Identify the J-code unit definition

- Confirm total dosage administered

- Divide the dosage by the unit definition

- Report the exact number of units

NDC Reporting and Unit Conversion

Modern J-code billing requires NDC reporting for most payers. This step is non-negotiable.

The NDC identifies the manufacturer and package. It must match what was purchased and administered.

Key elements include:

- 11-digit NDC format

- Correct unit qualifier (ML, UN, GR)

- Accurate NDC quantity

NDC units often differ from J-code units. Conversion must be done carefully. This is where many claims fail.

Reporting Drug Wastage Properly

Drug wastage is heavily regulated, especially by Medicare.

When part of a single-dose vial is discarded:

- Bill administered units on one line

- Bill wasted units on a separate line

- Append the JW modifier to the wasted units

When no drug is wasted, Medicare now requires the JZ modifier to confirm that zero wastage occurred.

Failure to report wastage correctly signals compliance issues. Auditors look closely at these claims.

Clear clinical documentation makes this step easier and defensible.

Applying Modifiers When Required

Modifiers communicate essential details to payers. Missing or incorrect modifiers often cause denials.

Common modifiers in J-code billing include:

- JW for discarded drug

- JZ for no wastage

- Modifier 25 when appropriate with E/M

- Site-specific modifiers as required

Modifiers should never be added blindly. They must reflect documented facts.

Claims scrubbers help, but human review remains essential.

Claim Submission With Supporting Information

Once coding is complete, the claim is submitted. For J-codes, submission often requires more than just codes.

Some payers require:

- Authorization numbers

- Drug invoices

- Clinical notes

- NDC details on claim lines

Unclassified J-codes like J3490 almost always need attachments. Submitting them without support delays payment.

Tracking high-dollar claims separately helps ensure timely follow-up.

Reimbursement Review and Payment Posting

Payment is not the end of the process. It is a checkpoint.

Drug reimbursement must be reviewed against:

- Expected Medicare ASP rates

- Contracted commercial rates

- Approved authorization terms

Underpayments are common. Many practices accept them unknowingly.

Regular reconciliation helps identify issues early. Appealing underpayments is often successful when the documentation is solid.

RCM benchmarks show that practices that audit drug payments recover significant lost revenue annually.

Medicare Rules for J-Code Billing

Medicare follows strict guidelines. But they are predictable once you know them.

Medicare Part B covers physician-administered drugs that are:

- Not self-administered

- Reasonable and necessary

- FDA-approved or compendia-supported

Reimbursement is based on Average Sales Price (ASP) + 6%, though sequestration reduces it slightly.

ASP updates quarterly. If your charge does not align, payment shrinks.

Medicare also enforces wastage reporting using JW and JZ modifiers. Failure to report wastage correctly can trigger audits.

Medicaid and Commercial Payer Variations

Medicaid rules vary by state. Some states require NDCs on all claims. Others deny without invoice uploads.

Commercial payers add another layer. Many require:

- Prior authorization

- White-bagging or brown-bagging compliance

- Site-of-care restrictions

Ignoring these rules leads to denied claims and patient balance issues.

High-Risk J-Codes and Unclassified Drugs

Codes like J3490 and J9999 cause trouble. They represent unclassified drugs.

These codes almost always require:

- Detailed descriptions

- NDC numbers

- Invoices

- Medical records

They delay payment, but remain necessary for new therapies.

Providers should track these claims separately. Follow up aggressively.

Common J-Code Billing Errors and How to Avoid Them

J-code billing looks simple on the surface. You administer a drug. You report the code. You expect payment. In reality, this is where many practices bleed revenue. J-codes sit at the crossroads of high cost, strict payer rules, and heavy audits. Even small mistakes trigger denials, underpayments, or post-payment recoupments.

As someone who has handled drug billing across oncology, rheumatology, GI, and infusion centers, I can say one thing clearly. Most J-code errors are preventable. They repeat because workflows break down, not because staff lack effort.

Let’s walk through the most common J-code billing errors in detail. More importantly, let’s talk about how to avoid them in real practice.

Billing the Wrong Number of Units

This is the most frequent and expensive mistake in J-code billing. J-codes are almost always unit-based. The unit definition matters more than the drug name itself.

Many drugs are billed per 1 mg, per 10 mg, or per 100 units. If the coder misreads the descriptor, reimbursement drops instantly.

For example, billing for one unit when ten units were administered cuts the payment by 90%.

This error often happens when staff rely on memory or old cheat sheets. CMS updates drug descriptors regularly. What worked last year may be wrong today.

To avoid this, always cross-check the J-code descriptor against the current CMS or payer drug tables. Build unit calculators into your billing workflow. Never assume. Drug math deserves a second look every time.

Missing or Incorrect NDC Information

Payers want to know exactly what drug you used. The J-code alone does not tell the whole story. That is why NDC reporting is now standard across Medicare, Medicaid, and commercial plans.

Common NDC mistakes include submitting a 10-digit NDC instead of an 11-digit NDC, using the wrong unit qualifier, or mismatching the NDC quantity with the J-code units.

Another issue shows up when practices switch suppliers. The J-code stays the same, but the NDC changes. If billing systems are not updated, denials follow fast.

Avoid this by tying pharmacy purchase records directly to billing workflows. Always convert NDC units correctly. Use ML, UN, or GR qualifiers based on the drug’s packaging. Train staff to treat NDC reporting as critical, not optional.

Failure to Report Drug Wastage Correctly

Drug wastage rules confuse many providers. Medicare requires wastage reporting when a single-dose vial is partially discarded. This is done using the JW modifier. When no drug is wasted, the JZ modifier is now required.

Missing these modifiers signals non-compliance. Incorrectly billing for waste can trigger audits or repayment demands months later.

This error usually occurs when clinical staff do not communicate wastage clearly to billing teams. Documentation may say “partial vial used” without stating how much was discarded.

The fix starts at the point of care. Document the administered amount and wasted amount clearly. Train billing staff to review notes carefully before claim submission. Add modifier checks into claim scrubbers.

CMS audits show that drug wastage reporting errors remain a top compliance risk in Part B billing. Clean documentation is your shield.

Using Expired or Invalid J-Codes

J-codes change more often than many realize. New drugs receive temporary codes. Others are replaced or deleted. Billing an expired code guarantees denial.

This usually happens when practices rely on outdated charge masters or static EHR templates. Once a code expires, payers automatically reject it.

Avoid this by reviewing code updates quarterly. CMS releases HCPCS updates regularly. Your billing system should reflect those changes quickly. If it does not, manual audits become necessary.

Expired code usage may seem minor, but it signals weak compliance controls. Payers notice patterns. Patterns invite scrutiny.

Billing J-Codes Without Medical Necessity Support

High-cost drugs demand strong justification. A diagnosis code alone rarely tells the whole story. Payers expect to see why the drug was needed, especially for biologics and specialty medications.

Claims fail when documentation lacks prior therapy history, treatment rationale, or response details. This is common with step-therapy drugs and off-label uses.

To prevent this, align clinical documentation with payer policies. Chart notes should explain disease severity, failed treatments, and expected outcomes. For Medicare, ensure coverage aligns with FDA labeling or recognized compendia.

Ignoring Prior Authorization Requirements

Many commercial payers require prior authorization for J-code drugs. Some Medicaid programs do as well. Administering first and checking later creates risk.

This error often happens in busy infusion centers where scheduling pressure overrides verification steps. Unfortunately, payers do not care how busy the clinic was.

Build authorization checks into scheduling workflows. Verify approval before drug administration. Track authorization numbers carefully and include them on claims when required.

Denied drug claims due to missing authorization are often non-appealable. That means the loss is permanent.

Incorrect Place of Service Reporting

Place of service affects drug reimbursement. Some drugs are covered only in specific settings. Others pay differently in office versus outpatient hospital environments.

Billing the wrong place of service can reduce payment or trigger denial. This error often occurs when services move between locations, but billing templates do not update.

Avoid this by confirming the service site for every encounter. Align POS codes with payer rules. Review claims for consistency between procedure, drug, and location.

Payers increasingly monitor site-of-care optimization to control costs. Accuracy matters more than ever.

Improper Use of Unclassified J-Codes

Codes like J3490 and J9999 exist for drugs without permanent codes. They are necessary but risky.

These claims almost always require additional documentation, invoices, and detailed descriptions. Submitting them without attachments delays payment or leads to denial.

Track unclassified drug claims separately. Attach supporting records proactively. Follow up aggressively. Do not let them age silently.

While inconvenient, these codes are familiar with new therapies. Managing them well separates strong billing teams from weak ones.

Underbilling or Accepting Incorrect Payments

Not all errors lead to denials. Some lead to silent underpayments. If expected reimbursement is not compared to actual payment, revenue slips away unnoticed.

This happens when practices do not reconcile payments against ASP rates or contracted fees. Over time, losses add up significantly.

Avoid this by auditing drug payments monthly. Compare paid amounts to expected rates. Appeal underpayments promptly.

Many practices recover thousands simply by paying attention.

Lack of Ongoing Staff Training

J-code rules evolve. Payer policies shift. Staff turnover happens. Without training, errors multiply.

One-time training is not enough. Drug billing requires continuous education. Updates should be shared regularly. Mistakes should be reviewed openly.

Final Thoughts

J-codes are not just another billing detail. They are revenue drivers and compliance triggers.

Handled well, they stabilize cash flow. Handled poorly, they quietly bleed money.

Providers who master J-codes gain control over one of the most complex areas of medical billing. That control brings confidence, consistency, and long-term financial health.

Stop Losing Money on Drug Claims

J-code billing leaves little room for error. One missed unit or modifier can cost thousands. Our billing experts handle drug coding, NDC reporting, payer rules, and denial recovery every day.

Let Us Protect Your Revenue While You Focus On Patient Care.

Partner With A2Z Billing Today

FAQs

What are J-codes mainly used for in medical billing?

J-codes are used to bill injectable and infused drugs administered by providers. They represent physician-administered medications rather than oral drugs dispensed by pharmacies. These codes help payers track drug usage, cost, and compliance.

Why do payers require NDC numbers with J-codes?

NDC numbers identify the exact drug and manufacturer. They help payers confirm what was purchased and administered. Without NDCs, payers cannot verify accuracy, which often leads to denials.

How does Medicare reimburse J-codes?

Medicare reimburses most J-codes based on Average Sales Price plus a percentage. The rate updates quarterly. Accurate units and modifiers are essential to receive full payment.

What is the JW modifier in J-code billing?

The JW modifier reports discarded drug amounts. Medicare requires it when a portion of a single-dose vial is wasted. Proper wastage reporting prevents compliance issues.

Are unclassified J-codes harder to get paid?

Yes. Codes like J3490 require extra documentation, invoices, and medical records. They take longer to process, but remain necessary for newer therapies.

How can providers reduce J-code denials?

Start with eligibility checks and prior authorization. Document clearly. Match units carefully. Include correct NDC data. Monitor payments closely. Consistency reduces denials over time.