The No Surprises Act has quietly changed how medical billing works in the United States.

But for healthcare providers, its impact has been anything but subtle.

Since the law took effect, billing teams, practice managers, and healthcare owners have had to rethink everyday workflows, from scheduling and eligibility checks to estimates, claims submission, and patient communication.

For years, surprise billing created tension across the system. Patients felt blindsided by unexpected charges. Providers relied on balance billing to offset low reimbursements. Insurers often controlled the outcome. The No Surprises Act stepped in to reset that balance and shift disputes away from patients.

This guide explains the No Surprise Act, what changed, and how to stay compliant without risking your revenue.

What Is the No Surprises Act?

The No Surprises Act became federal law on January 1, 2022. Its goal was simple but powerful. It aimed to stop patients from receiving unexpected medical bills when they had little or no control over who treated them.

Before this law, surprise billing was shared. A patient could carefully choose an in-network hospital and still receive a large out-of-network bill weeks later. Often, it came from providers they had never met or selected, such as anesthesiologists or radiologists.

Research before the law showed the scale of the problem. Nearly 20 percent of emergency room visits resulted in surprise bills. In hospital settings, about 1 in 6 inpatient stays included at least one out-of-network charge. The average surprise bill exceeded $1,200, with many exceeding $1,200.

The No Surprises Act shifted the financial fight away from patients. Instead of patients being stuck between insurers and providers, disputes now happen directly between payers and providers.

This change brought new responsibilities. Good faith estimates. Notice and consent rules. Independent dispute resolution. These are not optional steps. They are legal requirements.

Why Balance Billing Became a National Issue

To understand the Act, you need to understand balance billing.

Balance billing happens when an out-of-network provider bills a patient for the difference between their charge and what the insurance company pays. For years, this was legal in many scenarios.

From a provider standpoint, balance billing helped offset low payer reimbursement. Many specialists avoided joining networks because contracted rates barely covered costs. Balance billing gave leverage.

From a patient standpoint, it felt unfair. Patients often had no say in who treated them. Emergency care made the choice impossible. Hospital-based services made provider selection invisible.

The tension kept growing. Eventually, federal lawmakers stepped in.

The No Surprises Act does not eliminate balance billing. It limits it in situations where patients reasonably expect in-network care or cannot make informed choices.

Who the No Surprises Act Protects

The Act protects most patients with commercial health insurance, including:

- Employer-sponsored plans

- Individual and marketplace plans

- Federal employee health benefit plans

It does not apply to Medicare, Medicaid, VA, TRICARE, or Indian Health Services. Those programs already had protections in place.

Self-pay patients are also excluded from surprise billing protections. However, they fall under good-faith estimate rules, which create a different set of obligations for providers.

Services Covered Under the Act

The law focuses on situations where patients lack control. Three categories matter most.

Emergency Services

Emergency care receives the strongest protection. Patients pay only in-network cost-sharing, even if all providers involved are out of network.

The definition of emergency services is broad. It uses the prudent layperson standard. If a reasonable person believes their symptoms require immediate care, the visit qualifies as an emergency.

Chest pain. Severe abdominal pain. Shortness of breath. Even if the final diagnosis is not life-threatening, the protection applies.

Balance billing is completely prohibited for emergency services. No notice. No consent. No exceptions.

Non-Emergency Services at In-Network Facilities

This category affects hospital-based providers the most.

If a patient receives care at an in-network facility, many out-of-network providers cannot balance bill, even with patient consent. These include:

- Anesthesiology

- Radiology

- Pathology

- Neonatology

- Assistant surgeons

- Hospitalists

- Intensivists

Patients do not meaningfully choose these providers. The law recognizes that reality.

Other specialists may balance bill only if strict notice and consent rules are followed. The 72-hour written notice requirement applies here.

Air Ambulance Services

Air ambulance surprise bills were some of the worst in healthcare. Bills of $30,000 or more were everyday.

The Act now prohibits balance billing for air ambulance services. Patients owe only in-network cost-sharing.

Ground ambulances are not included. This remains a major gap and an area of ongoing advocacy.

Notice and Consent Rules

Notice and consent sound simple. In practice, they are one of the most difficult parts of compliance.

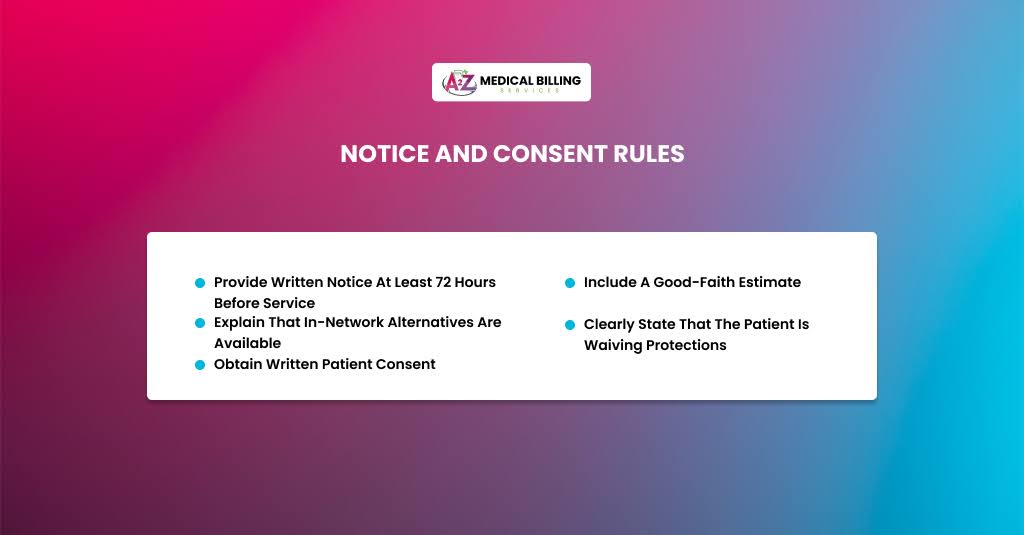

To balance the bill for eligible non-emergency services, providers must:

- Provide written notice at least 72 hours before service

- Include a good-faith estimate

- Explain that in-network alternatives are available

- Clearly state that the patient is waiving protections

- Obtain written patient consent

Consent is service-specific. If services change, new consent is required.

Ancillary services are excluded entirely. No amount of consent allows balance billing for them at in-network facilities.

Scheduling pressures make this challenging. Many practices had to redesign workflows to track notice timing and consent documentation.

Good Faith Estimates: What Providers Must Do

Reasonable faith estimates changed how self-pay billing works.

Every uninsured or self-pay patient must receive a written estimate before scheduled services.

Timing matters:

- Services scheduled 10+ days out: estimate within 3 business days

- Services scheduled sooner: estimate within 1 business day

- Unscheduled requests: estimate within 3 business days

The estimate must include:

- Expected charges for all reasonably anticipated services

- CPT and diagnosis codes

- Provider and facility details

- Clear disclaimers

If the final bill exceeds the estimate by $400 or more, the patient can dispute it.

This rule creates real financial risk. Underestimating leads to disputes. Overestimating scares patients away. Accuracy matters.

Many practices now use ranges instead of single figures. This reflects real-world variability and helps manage expectations.

Independent Dispute Resolution (IDR)

When insurers and providers disagree on payment, the patient stays out of it.

The IDR process works like baseball arbitration. Each side submits a payment amount. The arbitrator selects one.

The qualifying payment amount (QPA) is the median in-network rate and serves as the primary reference point.

Other factors include:

- Provider experience

- Service complexity

- Patient condition

- Case circumstances

The losing party pays the arbitration fee. This discourages unreasonable offers.

For providers, documentation is critical. Strong records often determine outcomes.

How the Act Impacts Billing Operations

The operational impact is real and ongoing.

Front desks now screen insurance status more carefully. Schedulers must identify out-of-network scenarios early. Billing teams must code claims correctly to reflect protected services.

Documentation workloads increased. Estimates, notices, consent forms, and audit trails are now compliance necessities.

Staff training is no longer optional. Everyone who touches scheduling, billing, or patient communication must understand the basics.

Administrative costs rose. Smaller practices felt this pressure the most.

How State Laws Interact With the No Surprises Act

No Surprise Act applies nationwide and supersedes weaker state laws, but does not replace state law where stronger protections exist.

If a state’s law offers equal or stronger protection than the NSA, then that state law generally applies. Federal rules step in where state law doesn’t cover a situation or is weaker.

Many state laws do not apply to self-insured plans governed by ERISA; the NSA mainly regulates both state-regulated plans and federal plans.

States With Comprehensive Surprise Billing Laws

These states have enacted broad protections that generally align with, or go beyond, federal NSA protections. They typically ban balance billing outright, restrict patient cost-sharing to in-network amounts, and include state dispute resolution processes in addition to the federal IDR system:

- California – Comprehensive balance billing protections, including strong provider reimbursement benchmarks.

- Colorado – Broad protections and enforcement infrastructure.

- Connecticut – Comprehensive surprise billing law covering many scenarios.

- Florida – Strong protections for emergency and some non-emergency services at in-network hospitals.

- Illinois – Laws banning surprise billing and providing dispute resolution.

- Maine – Comprehensive law covering emergency and hospital-based services.

- Maryland – Detailed balance billing protections and rate standards.

- New Hampshire – Expanded its surprise billing statute to align with federal protections.

- New Jersey – Strong comprehensive protection with state regulatory enforcement.

- New Mexico – Broad anti–balance billing law.

- New York – Strong protections and dispute processes have been in place for years.

- Oregon – Comprehensive surprise billing protections.

- Texas has a comprehensive law, including a dispute-resolution process (recently strengthened).

- Virginia – Broad protections at least as strong as federal law.

- Washington – Passed protective legislation for balance billing, including EMS coverage.

(Note: Lists vary slightly depending on definitions of “comprehensive.”)

In these states, surprise billing protections can include additional features beyond federal law, such as:

State-administered arbitration or rate-setting

Broader definitions of covered services

Protections for ground ambulance balance billing (in some cases)

Rules that apply to state-regulated commercial plans

States With Partial or Limited Protections

Some states protect patients against surprise bills in specific scenarios, but not as comprehensively as others:

- Arizona – Limited protections mainly for specific service types or contexts.

- Delaware – Partial protections that supplement federal law.

- Indiana – Recent laws addressing ambulance billing and some balance billing.

- Iowa – Emergency service protections but limited coverage otherwise.

- Minnesota – Some protections for emergency and hospital services.

- Mississippi has enacted laws regarding surprise billing for state-regulated plans.

- Nevada – Partial balance billing restrictions.

- Pennsylvania – Partial protections depending on plan type and services.

- Rhode Island – Limited protections aligned with the NSA.

- Vermont – Some state protections, often coordinating with federal rules.

- West Virginia – Partial protections with shared enforcement roles.

In these states, protections may be limited to:

- Emergency services only,

- Certain provider types or settings, or

- State-regulated plan populations (not ERISA/self-insured).

In these cases, the NSA fills the gaps, but providers must still be aware of both sets of rules.

States With Minimal or No Surprise Billing Laws

Several states historically have not enacted state surprise billing laws (or protections are very limited), making the federal NSA the primary source of protection for patients:

Examples include:

- Alabama

- Alaska

- Arkansas

- Idaho

- Hawaii

- Kansas

- Kentucky

- Louisiana

- Montana

- North Dakota

- South Carolina

- South Dakota

- Tennessee

- Utah

- Wisconsin

- Wyoming

In these states, the NSA provides the whole framework for protections against surprise bills under covered scenarios. Providers must rely on federal requirements where state protections don’t exist.

Unique State Protections: Ground Ambulance Billing

One central area where the NSA does not provide federal protection is ground ambulance surprise billing. This has led to a patchwork of state-level rules:

States with ground ambulance protections (state law beyond the NSA) include:

- Arkansas

- California

- Colorado

- Delaware

- Florida

- Illinois

- Indiana

- Louisiana

- Maine

- Maryland

- Mississippi

- New Hampshire (effective 2026)

- New York

- Ohio

- Oklahoma

- Oregon (effective 2026)

- Texas

- Utah (later 2025)

- Vermont

- Washington

- West Virginia

In many of these states, state-regulated insurance plans cannot balance bill patients for ground ambulance services beyond in-network cost-sharing. This is a valuable protection that patients don’t get under the federal law.

How the No Surprises Act Protects Healthcare Providers

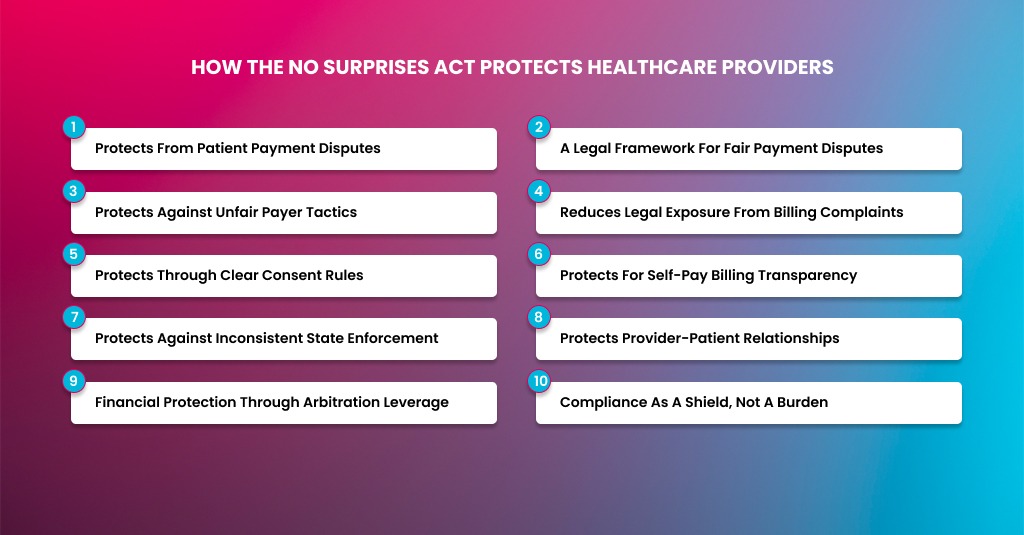

When most people hear about the No Surprises Act, they think it only protects patients. That is the common belief. In reality, the law also offers several essential protections for healthcare providers. These protections are not always obvious, especially when you are buried in daily billing, denials, and payer negotiations.

From my experience working deep inside revenue cycle operations, I can say this clearly. The No Surprises Act did not just take something away from providers. It also gave structure, leverage, and legal clarity that did not exist before.

If you understand how to use it correctly, the Act can protect your practice from patient disputes, reputational damage, and unfair payer behavior. It can even strengthen your negotiating position in the long run.

Protects From Patient Payment Disputes

Before the No Surprises Act, providers often found themselves in the middle of angry patient disputes. Patients would receive unexpected bills and blame the provider directly. Even when the bill was technically legal, the situation damaged trust and created friction.

The Act removes providers from that conflict in many situations.

When services fall under the No Surprises Act, patients are limited to in-network cost-sharing. They cannot be billed beyond that amount. This means patients no longer receive massive, unexpected invoices that trigger complaints, chargebacks, or legal threats against your practice.

From a provider perspective, this reduces reputational risk. It also reduces the time your billing team spends explaining bills, defending charges, or handling patient appeals. Instead of fighting with patients, payment disputes move where they belong, between providers and insurers.

That shift alone is a major form of protection.

A Legal Framework for Fair Payment Disputes

Before 2022, out-of-network providers had very little structure when insurers underpaid claims. If the payer sent a low reimbursement, the provider had two options. Accept it or balance the patient’s bill.

The No Surprises Act replaced that chaos with a formal Independent Dispute Resolution (IDR) process.

This protects providers in several ways.

First, it creates a legally recognized path to challenge underpayment. Providers are no longer forced to silently absorb low payments. If a payer issues an unreasonably low amount, the provider can initiate negotiation and arbitration.

Second, the process is binding. Once an arbitrator makes a decision, the payer must comply. This gives providers leverage they did not have before.

Third, the Act requires arbitrators to consider more than just insurer preferences. Provider training, experience, service complexity, and patient condition all matter. This prevents insurers from automatically pushing payments down to the lowest possible rate.

In short, the Act gives providers a seat at the table instead of leaving them powerless.

Protects Against Unfair Payer Tactics

Insurers previously used patient balance billing as an indirect pressure tool. They could pay low amounts, knowing providers might recover the difference from patients. That dynamic is gone in many scenarios.

Now, insurers must deal directly with providers.

This protects providers from silent underpayment strategies. When payers know their low offers can trigger arbitration, they become more cautious. Many disputes are resolved during the open negotiation period without formal arbitration.

From a billing standpoint, this has improved payment transparency. It also forces insurers to justify their reimbursement logic instead of hiding behind complex policies.

Providers who document services well and understand qualifying payment amounts are better protected against arbitrary payer reductions.

Reduces Legal Exposure From Billing Complaints

Patient lawsuits over surprise medical bills were on the rise before the Act. Even when providers followed existing rules, lawsuits still happened. Defense costs were high. Outcomes were unpredictable.

The No Surprises Act reduces this risk.

When providers comply with the Act, patients have limited grounds for legal claims related to surprise billing. The law clearly defines patient responsibility, provider obligations, and dispute channels.

This legal clarity protects providers from accusations of deceptive billing practices. It also strengthens defense positions if complaints escalate to regulators or courts.

Compliance is not just about avoiding fines. It is about reducing long-term legal exposure.

Protects Through Clear Consent Rules

One overlooked benefit of the Act is the clarity it provides.

Before the law, consent around out-of-network care was vague. Verbal disclosures were common. Documentation was inconsistent. This created risk for providers when disputes arose.

Now, consent rules are clearly defined.

If a provider complies with the written notice and consent requirements, they gain legal protection. The patient explicitly acknowledges out-of-network status and agrees to potential balance billing where permitted.

That signed consent becomes a strong defense if billing questions arise later. It protects providers from claims that patients were misled or uninformed.

Clear rules protect both sides when followed correctly.

Protects for Self-Pay Billing Transparency

Self-pay billing was another gray area before the Act. Patients often claimed they were never told how much the services would cost. Providers struggled to defend themselves without formal estimates.

Good faith estimates changed that.

By requiring written cost estimates for uninsured or self-pay patients, the Act creates documentation that protects providers. When estimates are accurate and delivered correctly, they set reasonable expectations.

If a patient later disputes charges, the estimate becomes evidence of transparency. Providers who follow the rules reduce the risk of payment disputes, refunds, or forced adjustments.

While estimates require effort, they also reduce financial surprises that often lead to non-payment.

Protects Against Inconsistent State Enforcement

Before the federal law, surprise billing rules varied widely by state. Providers operating in multiple states faced inconsistent requirements and unpredictable enforcement.

The No Surprises Act created a federal baseline.

This protects providers by standardizing rules across most commercial plans. While state laws still apply in some cases, the federal framework reduces confusion and inconsistency.

For multi-state practices, this consistency is a major operational advantage. It allows standardized workflows, training, and billing policies.

Predictability protects revenue.

Protects Provider-Patient Relationships

Billing disputes damage relationships. Once trust is broken, patient retention drops. Reviews suffer. Referrals decline.

By limiting surprise billing scenarios, the Act helps preserve provider-patient trust.

Patients feel protected. Providers avoid being seen as the source of unexpected costs. The financial conversation becomes more transparent and less adversarial.

This protection is indirect but consequential. Strong patient relationships translate into long-term practice stability.

Financial Protection Through Arbitration Leverage

While some providers fear arbitration, it actually offers protection when used strategically.

Insurers must consider the cost and risk of losing arbitration. This often leads to better settlement offers during negotiation.

Providers who understand their data, document complexity, and present strong cases often secure higher payments than initial insurer offers.

This protects revenue that would otherwise be lost.

The key is selective use. Arbitration should be used for high-impact claims where payment differences justify the effort.

Compliance as a Shield, Not a Burden

Many providers view the No Surprises Act as nothing more than compliance work. In reality, compliance is a shield.

When your practice follows the rules, you gain protection from:

- Patient disputes

- Regulatory penalties

- Legal challenges

- Payer underpayment tactics

Non-compliance creates risk. Compliance creates control.

From an RCM standpoint, the Act rewards organized, well-documented practices.

Closing Remarks

The No Surprises Act is more than a patient protection law. It is a structural shift in how healthcare payments, disputes, and responsibilities are handled. For providers, it limits balance billing in specific scenarios while replacing uncertainty with clear rules, defined processes, and new leverage against unfair payer practices.

Practices that treat the Act as a compliance burden often struggle. Practices that understand it as a framework for protection gain stability. Clear consent rules reduce disputes. Good faith estimates improve transparency. The IDR process creates a fair path to challenge underpayments. Together, these changes reduce legal exposure and strengthen long-term revenue integrity.

The key is execution. Strong documentation, trained staff, accurate estimates, and payer-aware billing workflows turn compliance into control. In today’s environment, understanding the No Surprises Act is no longer optional. It is a core part of protecting your practice, your patients, and your financial future.