Healthcare payments have evolved a lot over the last decade. Between rising premiums, confusing insurance plans, and never-ending billing codes, both providers and patients struggle to understand how costs are managed. One concept that often gets overlooked — but is incredibly valuable — is the Health Reimbursement Arrangement, commonly called an HRA.

If you’ve ever wondered how HRAs work, who qualifies for them, and how they tie into medical billing, this guide breaks everything down in simple, practical terms.

What is a Health Reimbursement Arrangement (HRA)?

A Health Reimbursement Arrangement (HRA) is an employer-funded health benefit plan that reimburses employees for qualified medical expenses. Unlike Health Savings Accounts (HSAs) or Flexible Spending Accounts (FSAs), employees don’t contribute their own money — the employer does.

Here’s the basic idea:

The employer sets aside a specific amount of money each year to help employees pay for healthcare costs, including deductibles, copays, prescriptions, and even insurance premiums. When an employee submits proof of an eligible expense, the employer reimburses them tax-free.

So instead of offering one-size-fits-all health insurance, an HRA gives flexibility — especially to small businesses and healthcare practices that want to control costs without cutting benefits.

In short, HRAs make healthcare benefits more personal, customizable, and cost-efficient for both sides.

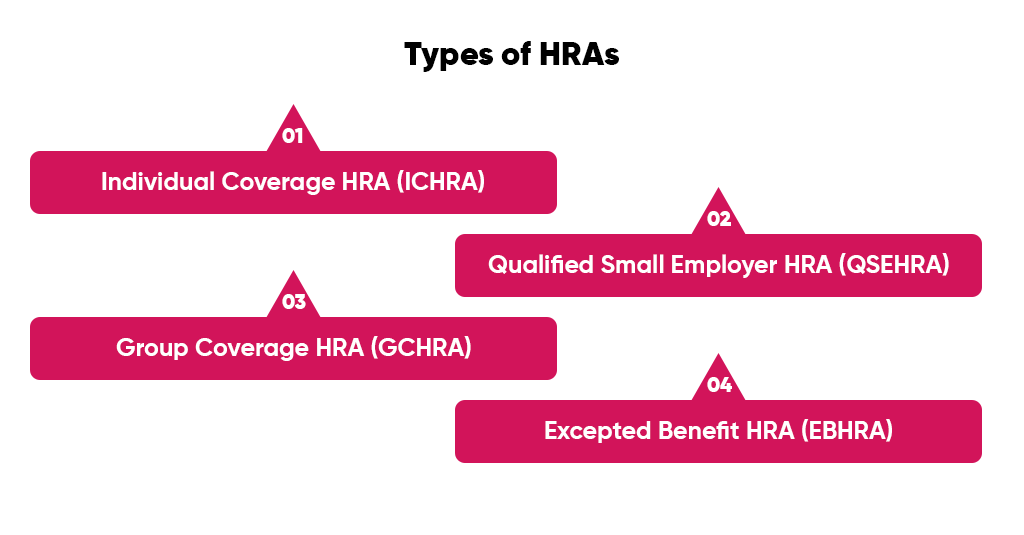

Types of HRAs

There isn’t just one kind of HRA. Different setups exist for different organization sizes, coverage goals, and IRS regulations. Let’s walk through the main ones you’ll come across in healthcare settings.

1. Individual Coverage HRA (ICHRA)

Individual Coverage HRAs (ICHRAs) allow employers to reimburse employees for individual health insurance premiums and other qualified expenses instead of offering a group health plan.

It’s perfect for employers who:

- Want to offer benefits but can’t afford traditional group insurance.

- Have employees in different states or coverage areas.

- Want flexibility without managing complex group plans.

For example, a clinic could give employees $400 per month through an ICHRA. Employees can then buy their own plans on the marketplace and get reimbursed. The employer stays compliant, and employees get freedom of choice.

2. Qualified Small Employer HRA (QSEHRA)

Designed for businesses with fewer than 50 full-time employees, a QSEHRA helps small practices provide tax-free health benefits without group plans.

Key highlights:

- The employer sets annual contribution limits (as per IRS caps).

- Employees can use funds for individual health insurance and medical expenses.

- Employers can reimburse up to a certain yearly amount (around $6,000+ for individuals, $12,000+ for families — exact limits adjust yearly).

Small medical practices, dental clinics, and private therapy offices often use QSEHRAs because they’re affordable, easy to manage, and keep everyone covered.

3. Group Coverage HRA (GCHRA)

A Group Coverage HRA works alongside a traditional group health plan. Employers offer a base group plan with higher deductibles (to save on premiums) and then use the HRA to reimburse employees for out-of-pocket costs like copays or deductibles.

Think of it as a safety net that fills the gap between what the insurance covers and what employees must pay.

Example:

A hospital might offer a high-deductible plan to staff but cover the first $1,500 of out-of-pocket expenses through a GCHRA. Employees feel protected, and the organization saves money on overall premium costs.

4. Excepted Benefit HRA (EBHRA)

Excepted Benefit HRAs (EBHRAs) are add-ons — they don’t replace regular insurance but can reimburse up to $2,100 (adjusted yearly) for “excepted benefits” such as:

- Dental and vision care

- COBRA premiums

- Short-term limited-duration insurance

- Other supplemental coverage

EBHRAs are useful for employees who opt out of the group plan but still want some financial cushion for medical extras.

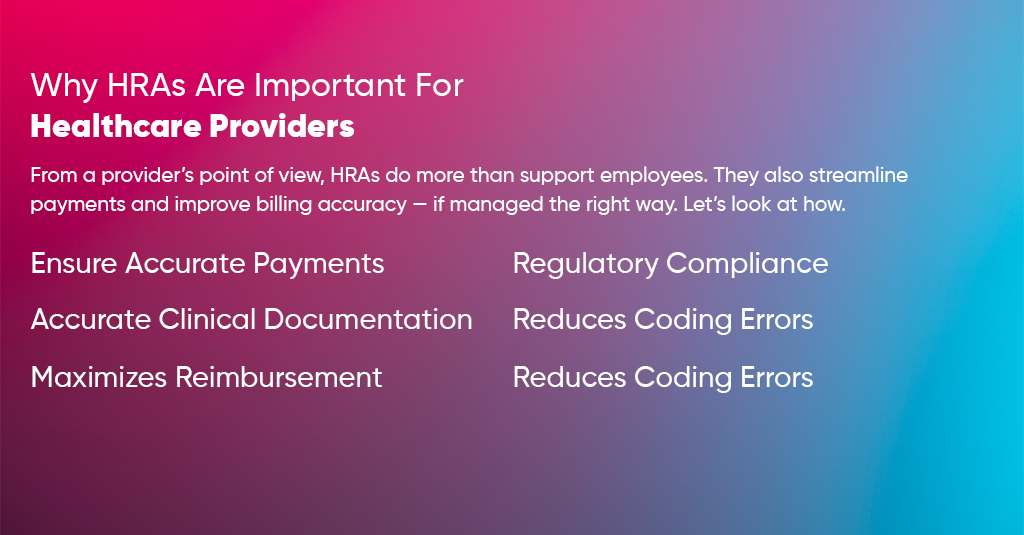

Why HRAs Are Important For Healthcare Providers

From a provider’s point of view, HRAs do more than support employees. They also streamline payments and improve billing accuracy — if managed the right way. Let’s look at how.

Ensure Accurate Payments

When HRAs are correctly integrated into billing systems, they ensure accurate and timely reimbursements for both patients and providers.

Instead of chasing unclear payments or partial balances, providers receive funds backed by employer HRA contributions — meaning less billing confusion and faster revenue cycles.

Regulatory Compliance

Healthcare billing is loaded with compliance landmines. HRAs operate under IRS and Department of Labor regulations, requiring documentation of every reimbursement. This naturally promotes transparent and compliant billing practices, keeping your medical office aligned with HIPAA, ERISA, and IRS rules.

Accurate Clinical Documentation

Accurate reimbursement starts with correct documentation. Since HRA claims often require proof of medical necessity or receipts, providers must document every detail clearly — diagnosis, treatment codes, procedure notes, and more. This reduces claim denials and strengthens your audit trail.

Reduces Coding Errors

HRA reimbursements are tied directly to eligible expenses and specific codes. When staff understand HRA rules, it helps them avoid coding mistakes — such as using non-reimbursable codes or mismatched modifiers. This boosts billing efficiency and prevents unnecessary denials.

Maximizes Reimbursement

When properly managed, HRAs help providers collect the full and rightful reimbursement from patients’ employer-funded accounts.

Instead of losing revenue due to uncollected balances, HRAs act as a pre-approved payment pool. Practices can verify eligibility upfront and confidently bill, knowing funds are available.

Who Is Eligible for an HRA?

Eligibility depends on the type of HRA and employer’s setup.

- For Employees: Anyone working for an employer that offers an HRA can participate — as long as they have a qualified health plan (for ICHRA/QSEHRA types).

Part-time, seasonal, or contract employees may be included or excluded depending on employer policy. - For Employers: Businesses of any size can set up HRAs. However, only small employers (under 50 employees) can use QSEHRA. Larger organizations usually choose ICHRA, GCHRA, or EBHRA based on structure and workforce diversity.

How to Use HRAs in Medical Billing

If you’re a healthcare provider or billing manager, understanding how HRAs fit into your billing process is essential. It can reduce patient confusion and speed up reimbursements.

Understand What an HRA Is

Educate your billing team about the employer’s specific HRA type. Each one reimburses different kinds of expenses, so you must know:

- Who funds it (always employer-funded)

- What counts as a qualified medical expense

- Any annual limits or exclusions

Example: A QSEHRA might reimburse for premiums and prescriptions, but not over-the-counter vitamins or cosmetic treatments.

Determine Eligible Expenses

Always confirm whether a service or procedure qualifies under the employee’s HRA.

Eligible expenses typically include:

- Deductibles and copays

- Prescription drugs

- Medical devices and diagnostic tests

- Dental and vision care (in some HRA types)

Your billing software should tag these as “HRA-eligible” expenses to avoid confusion.

The Reimbursement Process

Here’s how the HRA reimbursement process usually flows:

- Employee receives medical care → pays out-of-pocket.

- Provider submits a claim to the patient’s insurance.

- Employee submits proof (like an Explanation of Benefits or receipt) to their employer’s HRA administrator.

- Employer reimburses the employee tax-free from their HRA account.

In some cases, HRAs directly integrate with billing platforms, allowing electronic reimbursements straight to providers — a huge time-saver.

Key Considerations for Healthcare Providers

Before you start integrating HRAs into your billing workflow, it’s essential to understand how they fit within your revenue cycle management. HRAs can simplify payments and strengthen patient satisfaction, but only if your team handles them with precision and awareness. Here are a few crucial points to keep in mind:

Verify Eligibility Upfront

Never assume that every patient’s HRA covers all services. Always verify eligibility before the appointment or procedure. This means checking if:

- The patient’s employer actually offers an HRA.

- The HRA covers your specific type of service (some cover only premiums, others include out-of-pocket medical costs).

- The patient’s individual plan hasn’t hit its reimbursement cap.

By confirming these details early, your billing team avoids awkward conversations about unexpected balances later. It also ensures smoother cash flow since eligible claims are reimbursed faster.

Example: A patient may think their HRA covers prescription drugs, but their employer’s plan only reimburses insurance premiums. Knowing this upfront helps your staff guide the patient before billing errors occur.

Use Clear Documentation

Documentation can make or break HRA reimbursement. Every expense must be justified and traceable.

Always attach:

- Itemized receipts that show service descriptions and costs.

- Procedure and diagnosis codes that match the documentation are required.

- Medical necessity notes are essential for treatments that could be questioned as elective or cosmetic.

When documentation is complete and consistent, it not only supports reimbursement but also protects your practice in the event of an audit. Remember — HRAs are tax-advantaged, so the IRS expects a solid paper trail for every transaction.

Coordinate with Employers or HRA Administrators

Each HRA plan is unique. That’s why communication between your billing team and the employer (or third-party administrator) is critical.

Make sure your staff knows:

- Submission procedures (online vs. manual forms).

- Reimbursement timelines.

- What documents does the HRA administrator require for approval?

Many practices find it helpful to keep a quick-reference guide for their most common employer partners. This saves time and ensures consistency — especially when multiple staff members handle billing.

Stay Current with IRS Limits and Rules

HRA contribution limits, reimbursement categories, and eligibility criteria change almost every year. For instance, the IRS updates the annual contribution caps for QSEHRAs and EBHRAs regularly.

Staying updated on these changes ensures your billing policies remain compliant. It also helps your staff give accurate information to patients, as outdated guidance can lead to rejected claims or compliance issues.

To stay current, assign one billing manager or compliance officer to track IRS updates and refresh your internal policies each January.

Educate Patients

You’d be surprised how many patients confuse HRAs with HSAs (Health Savings Accounts) or FSAs (Flexible Spending Accounts). While all three help manage healthcare expenses, the rules are different — and misunderstanding them can delay payments.

Take a few minutes to explain how the patient’s HRA works:

- It’s funded by their employer, not by payroll deductions.

- Reimbursements are tax-free but require documentation.

- Some HRAs only reimburse after proof of payment.

A short, friendly explanation at check-in or during billing can prevent a lot of confusion later. It also shows that your practice understands financial wellness — something patients truly value.

Final Thoughts

Health Reimbursement Arrangements are one of those quiet innovations in healthcare finance that can make life easier for everyone — patients, providers, and employers alike.

For healthcare providers, HRAs mean faster payments, fewer denials, and better compliance. For employees, they mean flexibility and control over personal healthcare spending. When understood and used correctly, HRAs can be a win-win for any practice.

Let Us Help You Streamline Your Revenue Cycle, Reduce Denials, And Get Paid Faster

At A2Z Medical Billing Services, we simplify complex reimbursement systems like HRAs, HSAs, FSAs, and employer-sponsored benefits.

Our team ensures every eligible claim gets properly documented, coded, and reimbursed — without the compliance headaches.

Schedule a Free Consultation with A2Z Today

FAQs About Health Reimbursement Arrangements (HRAs)

1. What are the main types of HRAs in healthcare?

There are four main types of Health Reimbursement Arrangements (HRAs):

- Individual Coverage HRA (ICHRA): Allows employers to reimburse employees for individual health insurance premiums and qualified expenses.

- Qualified Small Employer HRA (QSEHRA): Designed for small businesses with fewer than 50 employees to offer tax-free healthcare reimbursements.

- Group Coverage HRA (GCHRA): Supplements an existing group plan by reimbursing employees for out-of-pocket costs like deductibles or copays.

- Excepted Benefit HRA (EBHRA): Offers limited reimbursement (up to a set IRS limit) for vision, dental, COBRA, or other supplemental benefits.

2. How do HRAs differ from HSAs and FSAs?

While all three help employees manage medical costs, they differ in structure and funding:

- HRAs are entirely employer-funded, and employees are reimbursed after submitting proof of eligible expenses.

- HSAs are employee-owned savings accounts, funded by the employee, employer, or both, and tied to high-deductible health plans.

- FSAs are employee-funded accounts, often through salary deductions, and unused funds may expire at year-end.

Simply put, HRAs provide employer-funded reimbursement, while HSAs and FSAs allow employees to spend pre-tax funds they’ve set aside themselves.

3. Who qualifies for an HRA?

Eligibility depends on the employer’s plan:

- Any employee whose employer offers an HRA can generally participate.

- For ICHRAs and QSEHRAs, employees must have a qualified health insurance plan.

- Employers can decide whether to include part-time or seasonal staff.

- Businesses of any size can offer an HRA, though QSEHRAs are limited to employers with fewer than 50 full-time employees.

4. How can healthcare providers process HRA reimbursements efficiently?

Providers can streamline HRA reimbursements by:

- Verifying eligibility upfront to ensure services qualify for reimbursement.

- Submitting clear, itemized documentation including CPT codes, diagnosis codes, and receipts.

- Coordinating with HRA administrators to understand documentation requirements and reimbursement timelines.

- Integrating HRA data into billing software for faster verification and fewer denials.

Using a professional billing company like A2Z Medical Billing Services ensures that reimbursements are handled accurately and in compliance with IRS and HIPAA rules.

5. Are HRA reimbursements taxable?

No, HRA reimbursements are not taxable as long as they’re used for qualified medical expenses defined by the IRS.

Employees don’t pay income or payroll taxes on these reimbursements, and employers can deduct the contributions as business expenses.

However, if funds are used for non-qualified expenses, those amounts become taxable to the employee.