If you ask any biller what keeps them up at night, “timely filing denials” will likely be among the top three.

Nothing stings more than providing care, submitting a claim late, and hearing back from the payer:

“Denied—timely filing limit exceeded.” That one error can cost hundreds or thousands of dollars in lost revenue—and unlike other denials, timely filing is often the most difficult to appeal.

In 2025, payers are getting even stricter. Medicare, Medicaid, and commercial insurers all have different time clocks, and some are tightening their policies. For providers and practices, knowing these limits isn’t optional—it’s a matter of survival.

This guide will walk you through:

- What timely filing limits are and why they matter

- Standard timelines for Medicare, Medicaid, and commercial payers

- How to calculate filing deadlines

- What counts as “proof of timely filing”

- Best practices to avoid denials

- FAQs every provider asks about TFL

Let’s start with the basics.

What is timely filing in medical billing?

In medical billing, the timely filing limit (TFL) is the maximum number of days a provider has to submit a claim to a payer after the date of service.

- If you miss the deadline, your claim will be denied.

- Most payers enforce it strictly, with very limited exceptions.

- Timeframes vary dramatically: Medicare is 1 year, BCBS is 90–180 days, and Medicaid is state-specific.

For example, if you saw a patient on Jan 10, 2025, and your payer has a 90-day timely filing limit, your claim must reach them by April 10, 2025. Send it on April 12? It’s too late — even if you mailed it earlier, but it didn’t get processed.

Why Timely Filing Matters More in 2025

- Stricter Payer Policies: Payers are utilizing AI-driven claim scrubbing, which means late claims never even reach human review.

- Cash Flow Impact: Missing a filing window can result in thousands of dollars in unrecoverable revenue.

- Audit Risks: Practices that routinely push deadlines are more likely to be flagged for review.

In short, staying ahead of timely filing is no longer a “best practice.” It’s mandatory for financial survival.

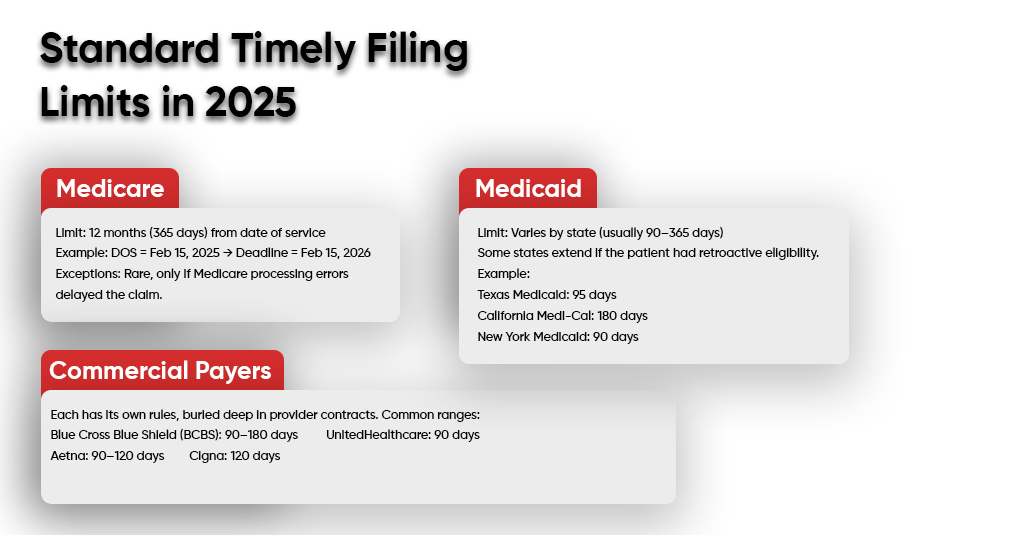

Standard Timely Filing Limits in 2025

1. Medicare

- Limit: 12 months (365 days) from date of service

- Example: DOS = Feb 15, 2025 → Deadline = Feb 15, 2026

- Exceptions: Rare, only if Medicare processing errors delayed the claim.

2. Medicaid

- Limit: Varies by state (usually 90–365 days)

- Some states extend if the patient had retroactive eligibility.

- Example:

- Texas Medicaid: 95 days

- California Medi-Cal: 180 days

- New York Medicaid: 90 days

3. Commercial Payers

Each has its own rules, buried deep in provider contracts. Common ranges:

- Blue Cross Blue Shield (BCBS): 90–180 days

- UnitedHealthcare: 90 days

- Aetna: 90–120 days

- Cigna: 120 days

If you’re contracted with multiple payers, create a master chart of TFLs and post it in your billing office.

How to Calculate Timely Filing Limits

- Start Date: The date of service (or discharge date if inpatient).

- End Date: Add the allowed days per payer.

- Example:

- Patient visit: March 1, 2025

- Payer TFL: 120 days

- Deadline: June 29, 2025

Important: It’s not enough to submit the claim before the deadline — it must be received by the payer on or before the deadline.

Proof of Timely Filing

When payers deny claims for TFL, they may sometimes request proof. Acceptable forms include:

- Clearinghouse acceptance reports

- Electronic submission confirmation (with timestamps)

- Certified mail receipts (if paper claims)

- EOB/RA from secondary payer (for crossover claims)

Don’t rely on “we mailed it.” Payers need actual proof that they received it within the window.

Denials & Appeals for Timely Filing

Every provider has seen that dreaded line on an Explanation of Benefits (EOB):

“Claim denied – exceeds timely filing limit.”

It’s frustrating because by the time you catch it, the clock has already run out. But the rules for appeals vary depending on whether you’re dealing with Medicare, Medicaid, or commercial payers.

Medicare

With Medicare, timely filing is a matter of strict adherence to the rules and regulations. The rule is 12 months from the date of service. If you miss it, appeals rarely succeed unless there’s a true administrative error — for example, Medicare had the wrong beneficiary ID on file or the patient’s entitlement status changed after the date of service. Outside of that, the door is basically closed.

Medicaid

Medicaid provides a little more breathing room, but the rules vary from state to state. A common exception is when patient eligibility is granted retroactively. Imagine a patient receives Medicaid approval a few months after treatment. In that case, you can resubmit within the revised eligibility period, even if the standard filing window expired. You’ll need proof of the eligibility update in the Medicaid system.

Commercial Payers

Commercial insurers (like BCBS, Aetna, UHC) live in the gray area. Most set limits between 90 and 180 days, but they sometimes allow appeals if you can prove the claim was originally submitted on time. This is where your clearinghouse reports become gold. If you can produce a transmission confirmation showing that the claim was sent out before the deadline, you may be able to overturn the denial.

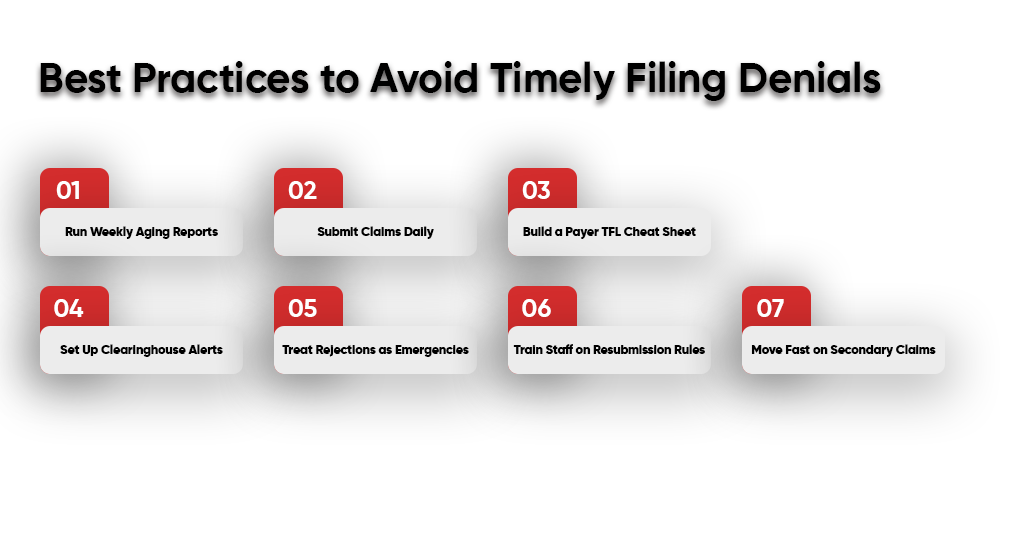

Best Practices to Avoid Timely Filing Denials

Timely filing denials don’t just waste money — they eat into staff morale and cash flow. Here’s exactly what your team should do every week to stay ahead of payer deadlines.

Run Weekly Aging Reports

- Set your billing software to auto-generate aging reports every Monday morning.

- Filter for claims older than 30 days but not yet submitted.

- Assign those claims to specific staff members the same day to clear them.

Submit Claims Daily

- Make it policy that all encounters are billed within 24 hours.

- Stop batching by week — it saves no money but costs revenue.

- Track compliance: audit once a month to confirm staff are meeting this rule.

Build a Payer TFL Cheat Sheet

- Create a simple one-page chart listing payers along with their respective timely filing limits (e.g., Medicare: 12 months, BCBS: 90 days).

- Print it, laminate it, and post it at every billing workstation.

- Update it every January and July, as some commercial plans adjust deadlines mid-year.

Set Up Clearinghouse Alerts

- Log in to your clearinghouse and enable “timely filing” reminders (most platforms offer this feature, but it’s often overlooked).

- Configure alerts for claims at 50% and 75% of their filing window.

- Route those alerts to both the biller and the billing manager so nothing slips.

Treat Rejections as Emergencies

- Require staff to check clearinghouse rejection reports twice a day.

- Any rejected claim must be corrected and resubmitted within 48 hours — no exceptions.

- Keep a rejection log so recurring errors (like missing modifiers) can be fixed at the root.

Train Staff on Resubmission Rules

- Hold a quarterly refresher training where you remind staff:

- A corrected claim does not reset the timely filing clock.

- Always reference the original submission date.

- Use real denial letters from your practice as training examples.

Move Fast on Secondary Claims

- Once the primary EOB is received, the secondary claim must be filed within seven business days.

- Assign one staff member as the secondary claims lead so accountability is clear.

- Track secondary claim turnaround time on your monthly KPI dashboard.

Conclusion

Timely filing limits may sound like administrative red tape, but they’re one of the biggest factors in whether you get paid or not. The difference between submitting a claim on time and missing the window could mean the difference between smooth cash flow and unrecoverable revenue loss.

As we step into 2025, with payers automating denial processes, practices can’t afford to leave TFL management to chance. Build a workflow, set post-deadline reminders, train your staff, and treat timely filing as seriously as patient care.

Because at the end of the day, no matter how well you treat your patients, if your claims aren’t filed on time, you’re working for free.

| Ensure you never miss the claim-filing deadline. One late claim can cost you hundreds of dollars. A pattern of late claims can cost you thousands of dollars. Don’t let timely filing rules eat away at your revenue. At A2Z Billing, we build airtight systems that: – Track every payer’s deadline. – Flag claims before they expire. – Handle denials and appeals the right way. A2Z Billing Experts in the USA protects your practice from preventable write-offs. Book your free strategy call today. |

FAQs

Does resubmitting a corrected claim extend the timely filing limit?

No. The clock starts from the original service date. Resubmissions must still fall within the original limit.

What if a patient’s insurance info was wrong at the time of service?

Most payers allow an exception if the patient had retroactive coverage, and you can prove eligibility.

How does secondary insurance affect Timely Filing Limits?

You must submit to the secondary payer within their filing limit, starting from the date on the primary EOB, not the original DOS.

Can providers get exceptions for natural disasters or EMR outages?

Some payers, including Medicare, allow exceptions if CMS or the state issues a formal disaster declaration.

What’s the shortest filing limit in commercial plans?

Some self-funded employer plans (through BCBS or UHC) have limits as short as 60 days — always read your contract.

What happens if a clearinghouse rejects a claim?

It doesn’t count as filed. The claim is considered submitted only when accepted by the payer. Always check clearinghouse reports.

How can practices efficiently track multiple payers’ deadlines?

Use your practice management system (PMS) to set payer-specific rules and generate weekly alerts for upcoming TFLs.