If you’ve worked in healthcare billing for more than a week, you’ve probably run into claim denials. They’re frustrating, they slow down cash flow, and if left unmanaged, they can accumulate into a severe revenue loss. According to MGMA, the average denial rate for practices is 5–10%, but some specialties see rates as high as 20%.

One of the most essential tools for understanding and fixing denials is the denial code. Think of denial codes as the “reason codes” payers give you when they say: “Sorry, we’re not paying this claim, and here’s why.”

In this guide, we’ll break down everything you need to know about denial codes, including categories, typical examples, payer-specific quirks, and how to respond effectively.

What Are Denial Codes?

A denial code is a standardized code assigned by insurance companies when they reject, delay, or reduce payment on a claim. These codes explain why the payer didn’t pay. They help providers determine what went wrong—whether it’s missing information, patient eligibility issues, coding mistakes, or policy exclusions.

There are two major types of codes you’ll see:

- CARC (Claim Adjustment Reason Codes): Explain why the claim or service line was adjusted.

- RARC (Remittance Advice Remark Codes): Provide additional detail or clarification about the adjustment.

Example: A claim might show CARC 16 (Claim/service lacks information) and RARC M51 (Missing/incomplete/invalid procedure code(s)).

Why Denial Codes Matter

Denial codes aren’t just a matter of payer red tape. They serve as roadmaps for improving revenue cycle performance.

- They show trends (e.g., if 40% of your denials are eligibility-related, you know where to fix the workflow).

- They help you respond faster with targeted appeals.

- They prevent repeat mistakes by alerting staff to documentation or coding issues.

- They ensure compliance with payer rules and mitigate audit risks.

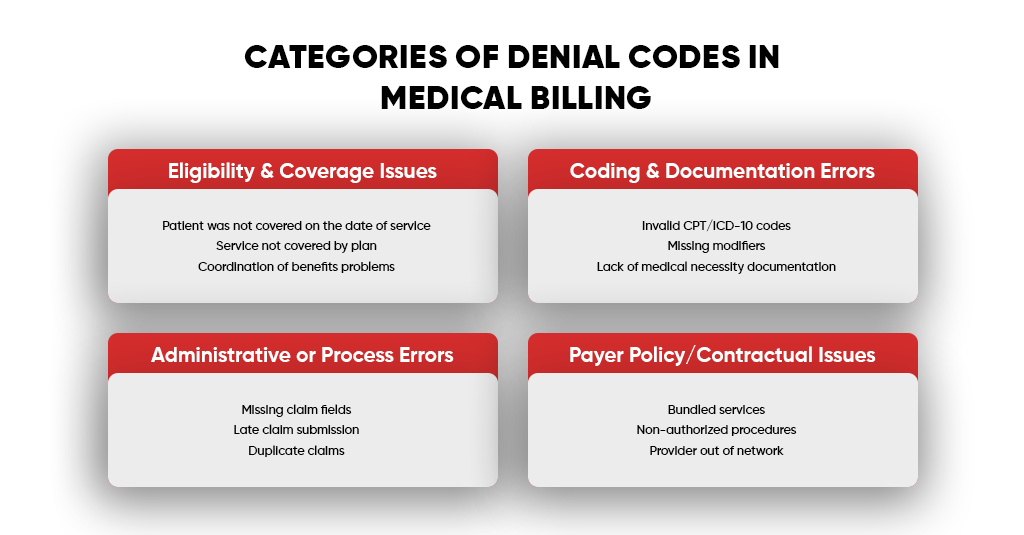

Categories of Denial Codes in Medical Billing

Denial reasons usually fall into a few big buckets:

- Eligibility & Coverage Issues

- Patient was not covered on the date of service

- Service not covered by plan

- Coordination of benefits problems

- Coding & Documentation Errors

- Invalid CPT/ICD-10 codes

- Missing modifiers

- Lack of medical necessity documentation

- Administrative or Process Errors

- Missing claim fields

- Late claim submission

- Duplicate claims

- Payer Policy/Contractual Issues

- Bundled services

- Non-authorized procedures

- Provider out of network

Standard Denial Codes Every Biller Should Know

Denial codes are like shorthand messages from payers. The problem is that they often appear cryptic until you translate them into plain English. Below is a breakdown of the most common codes, what they mean, real-world examples, and what you can do about them.

CO 11 – Diagnosis inconsistent with procedure

The diagnosis code doesn’t support the CPT/HCPCS code billed. In other words, the payer doesn’t believe the medical reason justifies the service.

- Example: Submitting a claim for a colonoscopy but using a diagnosis like “annual exam.” Preventive visits and screenings have specific codes, and using the incorrect diagnosis can make the service appear unnecessary.

- Fix/Prevention: Always verify the LCD (Local Coverage Determination) or payer medical policy to ensure your diagnosis aligns with the covered indication for the procedure. Train providers to document “why” the test or service is being ordered.

CO 16 – Claim/service lacks information

Required information is missing, incomplete, or invalid.

- Example: Submitting a claim without the referring provider’s NPI, or leaving out a modifier for bilateral procedures. Some payers even require “treatment authorization codes” and deny without them.

- Fix/Prevention: Utilize an EHR or clearinghouse claim scrubber that flags missing data before submission. Create a checklist for front-office staff to confirm all required fields (subscriber ID, DOB, policy number, etc.) are entered correctly.

CO 18 – Duplicate claim/service

The payer believes you submitted the same service more than once.

- Example: If a patient has two office visits on the same day with the same provider and you submit them without modifier -25 (significant, separately identifiable E/M service), one will get denied as a duplicate.

- Fix/Prevention: Before resubmitting a claim, check the claim status to avoid duplicate submissions. Use correct modifiers to show when a second service is truly separate.

CO 29 – The time limit for filing has expired

The claim was not submitted within the payer’s filing deadline.

- Example: Medicare requires claims to be submitted within 1 year of the date of service, while commercial plans may only allow 90–180 days. If you miss the window, it’s usually unrecoverable.

- Fix/Prevention: Set up automated tickler systems in your billing software to flag unbilled charges. Track payer-specific deadlines. If a claim is denied incorrectly, appeal with proof of timely filing (submission reports, clearinghouse receipts).

PR 1 – Deductible amount

The patient is responsible for the deductible portion, so the payer won’t pay until it’s met.

- Example: A patient with a $2,000 annual deductible comes in for a $500 MRI. If their deductible isn’t met, the full $500 is their responsibility.

- Fix/Prevention: Collect upfront. Use eligibility tools to check remaining deductible balances before service.

CO 50 – Non-covered services

The service is not covered under the patient’s policy.

- Example: Cosmetic procedures like mole removals or fertility treatments. Or billing a routine physical exam under Medicare Part B (which only covers “Welcome to Medicare” or “Annual Wellness Visits,” not traditional physicals).

- Fix/Prevention: Verify coverage before scheduling services. For services that may not be covered, obtain an Advance Beneficiary Notice (ABN) or a payer-specific waiver, signed so that you can bill the patient.

CO 97 – Service not paid separately

The billed service is bundled into another procedure and cannot be billed separately.

- Example: Billing for “surgical tray” (99070) during a minor office procedure. Most payers consider it bundled into the payment for the procedure.

- Fix/Prevention: Review the Correct Coding Initiative (CCI) edits before billing. If services are truly distinct, use appropriate modifiers (-59 or -X series).

PR 2 – Coinsurance amount

The patient is responsible for their share of the cost, as outlined in the plan terms.

- Example: Patient has an 80/20 plan. For a $1,000 covered service, the payer pays $800, and the patient is responsible for $200.

- Fix/Prevention: Train staff to explain coinsurance at check-in. Send estimates so patients aren’t blindsided by balances later.

PR 3 – Co-payment amount

The patient is required to pay a fixed co-payment for the visit.

- Example: Office visit copay is $30. If you don’t collect it upfront, the payer will deduct it and apply the balance to the patient.

- Fix/Prevention: Always collect copays at check-in. Post clear copay policies in the office and enable card-on-file systems for easier patient payments.

Payer-Specific Rules for Denied Codes

Different payers may use the same denial codes, but the context and rules differ:

- Medicare:

- Heavy focus on medical necessity. Claims are denied if the diagnosis codes don’t match the NCDs/LCDs.

- Strict with modifiers (e.g., modifier -25 or -59 misuse often triggers audits).

- A one-year timely filing limit applies, with no exceptions.

- Medicaid:

- Rules vary by state. For example, some require prior authorization for even the most basic imaging tests.

- Many states have “one trip per day” rules for NEMT services, which result in CO 18 (duplicate) claims.

- Filing deadlines are usually shorter (90 days in some states).

- Commercial Payers:

- More denials for out-of-network services or vague “not medically necessary” determinations.

- Use “clinical edits” that bundle services more aggressively than Medicare.

- Appeals often need peer-to-peer reviews or extensive documentation.

The Denial Management Process (In Practice)

Denial management isn’t just about “fixing” rejected claims—it’s about building a cycle of detection, correction, and prevention. Think of it like treating a chronic condition: you don’t just address the symptom, you find the root cause and adjust so it doesn’t keep coming back.

Here’s what a practical denial management workflow looks like in a busy medical practice or billing office:

Identify – Catch Denials Quickly

- Run denial reports on a weekly basis (not monthly). Use your clearinghouse or billing software to filter denials by CARC/RARC codes.

- Create a “Top 10 Denials” list. Focus on the codes causing the most revenue loss, not just the most frequent.

- Assign responsibility. Designate a denial specialist or AR team member to review new denials on a daily basis.

Correct – Fix and Resubmit Fast

- Develop a denial resolution checklist. For each denial code, have a standard fix. Example:

- CO 16 → Check missing NPI, modifiers, and authorization code.

- CO 18 → Verify if duplicate or if a modifier (e.g., -25) was missing.

- Set turnaround targets. Require staff to correct and resubmit denials within 48–72 hours.

- Keep documentation ready. Attach corrected codes, medical notes, or authorizations before resubmission.

Appeal – Push Back Strategically

- Don’t auto-resubmit. If a claim is denied for medical necessity (e.g., CO 11), prepare an appeal letter with supporting documentation.

- Use payer guidelines. Reference Local Coverage Determinations (LCDs), National Coverage Determinations (NCDs), or payer policy manuals in your appeal.

- Track appeal deadlines. Most payers have 30–180 days for appeals. Use task reminders to avoid missing them.

Track & Trend – Spot the Patterns

- Build a denial dashboard. Track denials by:

- Payer

- Provider

- Denial code

- Dollar value

- Do monthly denial reviews. Meet with staff or providers to go over recurring patterns.

- Target high-impact areas. If one payer is denying for “timely filing” more often, investigate workflow delays.

Prevent – Fix the Root Cause

- Tighten front-end processes.

- Verify eligibility at scheduling and check-in.

- Get prior authorizations for high-risk services.

- Collect copays and deductibles upfront.

- Train providers and staff. Educate them on coding rules, documentation requirements, and payer-specific quirks.

- Leverage automation. Utilize claim scrubbers and EHR alerts to identify and correct errors before submission.

Tips & Best Practices for Reducing Denials (Detailed)

- Front-End Accuracy is Everything: 70–80% of denials are preventable if caught before submission.

- Invest in Staff Training: Denials often stem from a lack of coding knowledge or incomplete documentation.

- Use Real-Time Eligibility Verification: Don’t just photocopy insurance cards—verify active coverage.

- Appeal Intelligently: Include clinical notes, operative reports, and payer guidelines in appeals. A “one-liner” appeal almost always fails.

- Automate Where Possible: Claim scrubbers and denial dashboards save hours of manual work.

- Prioritize High-Dollar Denials: Focus first on claims with the highest value to maximize recovery.

Final Thoughts

Denial codes might feel like nothing more than administrative headaches, but in reality, they are one of the most powerful diagnostic tools in revenue cycle management. Each denial code is a clue. When you start looking at them collectively, they stop being “bad news” and start being a map to your revenue leaks.

Think about it this way:

- If 40% of your denials are eligibility-related (CO 16, CO 29), it’s not a payer problem—it’s a front-desk or intake process issue.

- If most denials are for medical necessity (CO 11, CO 50), your providers may need better documentation or a clearer understanding of payer policies.

- If duplicates (CO 18) are common, it may indicate that you lack effective internal claim tracking.

By treating denial codes as business intelligence, you can make targeted changes that produce measurable results. In fact, practices that actively manage denials can:

- Recover 70–90% of denied claims through timely corrections and appeals.

- Reduce denial rates by 50% within 12 months by optimizing workflows.

- Boost collections by 5–15% annually, just by plugging these revenue leaks.

The real takeaway? Denials are not the enemy. Ignoring them is. Every denial you let sit is lost revenue, longer AR days, and higher staff frustration. However, every denial you investigate is an opportunity to strengthen your revenue cycle, educate your team, and prevent future losses.